Here are the latest key points from the Trump administration’s tax plan for 2018 and beyond. The administration’s goal is to get the plan enacted before 2018. Surely there will be some compromises before the final plan gets passed, if at all.

Here are the latest key points from the Trump administration’s tax plan for 2018 and beyond. The administration’s goal is to get the plan enacted before 2018. Surely there will be some compromises before the final plan gets passed, if at all.

After reviewing the key points, I share my thoughts on how to win under this possibly new tax environment.

Republican Tax Plan Highlights

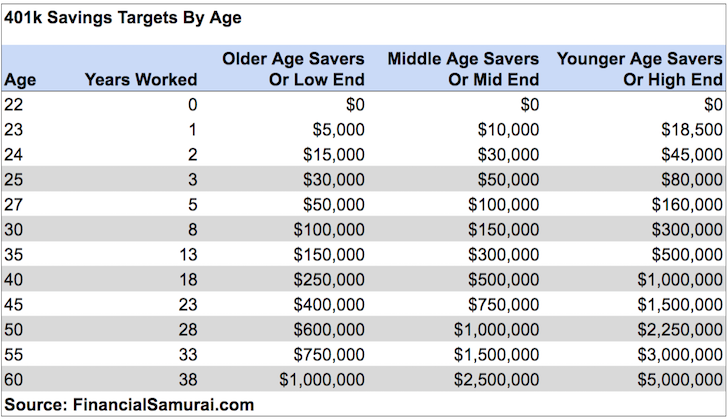

* No change to existing rules on 401k retirement accounts and the ability to contribute the current $18,000 into the accounts tax-free, and $18,500 for 2018 and beyond

* Lowers the deduction for mortgage interest for new home loans of $500,000 or less from the current $1,000,000 cap.

* Limits the deductibility of local property taxes to $10,000

* Eliminates the deduction for state income taxes

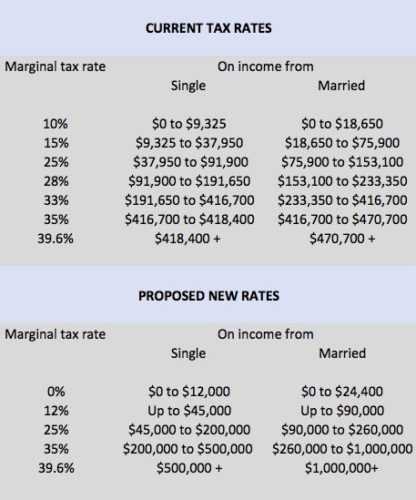

* Reduces the number of tax brackets from seven to three or four, with respective tax rates of 12 percent, 25 percent, 35 percent and a category still to be determined.

* The plan sets a 25 percent tax rate starting at $90,000 for married couples, with a 35 percent rate kicking in at $260,000

* Individuals making over $500,000 and couples earning over $1 million may still pay 39.6 percent

* Reduce the corporate tax rate from 35 percent to 20 percent

* Repeal the estate tax completely e.g. remove taxes on inheritances over $5.49M per individual and $10.98M per couple

* Increase child tax credit from $1,000 to $1,600, though the $4,050 per child exemption would be repealed.

* Nearly double the standard deduction used by most average Americans to $12,000 for individuals and $24,000 for families

* Finally, the lowest tax bracket would be 12 percent, down from 15 percent. The middle rate would be 25 percent, down from 28 percent. The third bracket would be taxed 35 percent, down from 39.6 percent. The top bracket would retain the 39.6 percent tax rate, but for income above $1,000,000 for married folks and above $500,000 for individuals.

How To Win Under The New Republican Tax Plan

1) Continue to max out your 401k. There’s no reason not to take advantage of tax-deferred investment growth and potential company matching / profit sharing.

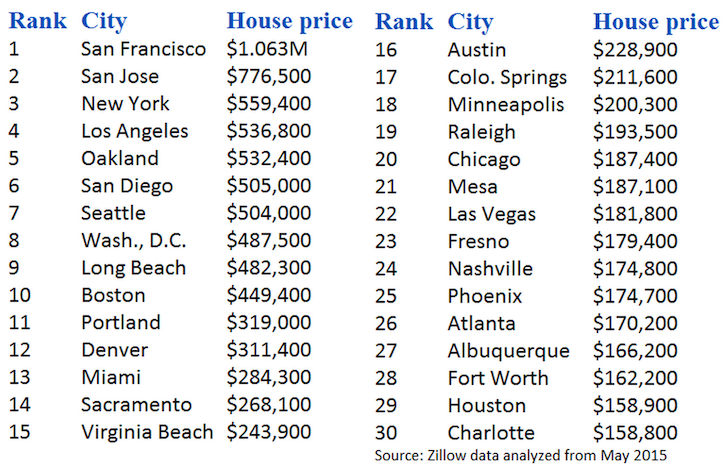

2) Reduce real estate exposure in the most expensive cities. Slashing mortgage interest deductibility on debt down to $500,000 from $1,000,000 may put downward pressure on homes priced above $625,000. $625,000 is the cut off because most people put down at most 20% and borrow the rest (80% X $625,000 = $500,000).

The real estate segment that will likely come under the most pressure are those homes priced above $1,250,000 and up until about $3,000,000. In this price range, taking out a $1,000,000 or higher mortgage debt is quite common. After $3,000,000, the percentage of buyers who pay cash increases, and the segment will therefore be less affected. However, if there is weakness at lower price points, it will ultimately drag down higher price points.

Areas such as San Francisco, San Jose, Oakland, Manhattan, Brooklyn, Los Angeles, San Diego, Washington D.C., Seattle, Boston, may experience weakness at the margin.

Related: Why I’m Investing In The Heartland Of America

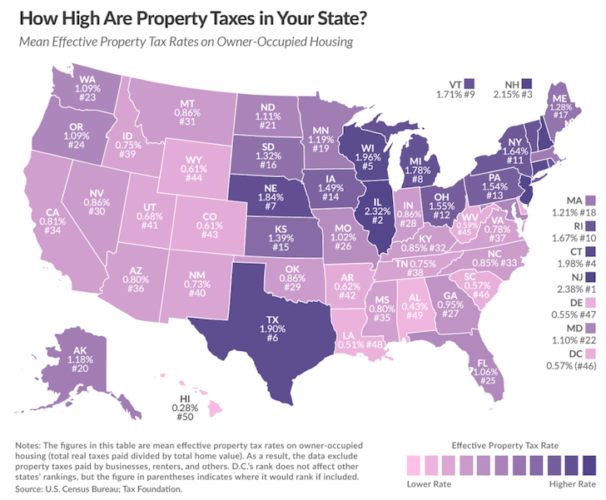

3) Move out of states with high property tax rates. Limiting the property tax deductibility to $10,000 will hurt homeowners who live in high property tax states or who own expensive property or both. Residents of California, New Jersey, New York, and less so Illinois should look to move or sell their property and rent. Although Utah, Wyoming, Arkansas, Alabama, West Virginia, and Louisiana have high property taxe rates, real estate in most parts of those states are relatively inexpensive. Hawaii has the lowest property tax rate, but also one of the highest real estate prices.

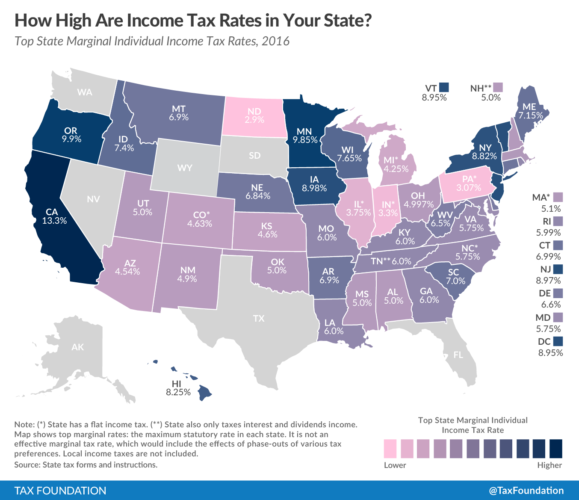

4) Move out of states with high state income tax rates. Consider relocating to one of the seven states with no state income tax: Washington, Nevada, Wyoming, South Dakota, Texas, Florida, or Alaska. No longer being able to deduct state income taxes will hurt states like New York, DC, Iowa, Minnesota, and New Jersey the most because life is hard in the states with high tax rates and brutal winters. At least in California, residents can play outside year around. But make no mistake, California residents lose under the new proposal.

5) Get married and make up to $1,000,000. The current top tax rate is 39.6% for individuals making more than ~$420,000 and married couples making more than $470,000. That rate is set to decline by 4.6% to 35% if the GOP plan passes. If you are an individual, the proposal is for you to pay the 39.6% tax rate again on income above $500,000, so you’re really only saving $80,000 X 4.6% = $3,680. But if you are married, your benefit is $530,000 X 4.6% = $24,380 because the threshold goes up to $1,000,000.

The roughly doubling of income threshold makes sense for those who believe in equality between man and woman. For example, if a man and woman each make $400,000 a year for a combined total income of $800,000, why would they ever get married if they now have to pay a 39.6% tax rate above $470,000 on their combined income? They would simple remain single in order to pay a 33% top marginal tax rate as individuals, saving themselves roughly $21,000 a year in marriage penalty tax ($800,000 – $470,000 = $330,000 X 6.6% = $21,780 minus income paying the 35% marginal tax rate).

Related: The Average Net Worth For The Above Average Married Couple

6) Start a LLC or S-Corp to earn pass through income. If the top tax rate for businesses with pass-through income declines to 25%, you’re basically winning if you have operating profits of over $92,000 per individual or $153,000 per married couple because those are the cutoff amounts for a 25% marginal income tax rate.

If you don’t have a business idea, then consider switching from full-time employee to consultant and having your old employer pay you a higher rate as a business. They might oblige since they don’t have to pay you any benefits.

If you aren’t willing to start a business or become an independent contractor, then consider investing in businesses that will benefit from the corporate tax cut to 20%. And if you don’t know what company to invest in, then you can simply buy an S&P 500 index fund.

Related: The 10 Best Reasons To Start An Online Business

7) Step on the gas when it comes to building wealth, or die before Trump leaves office. Repealing the death tax should motivate you to try and accumulate far beyond $5.49M as possible to leave to your loved ones or charitable organizations you care about. But even if the death tax limits are repealed, they will likely be reinstated with the next administration, unless every single administration after Trump’s is Republican.

If you have the ability and motivation to build great wealth, you might as well go for it during this window. As soon as you start thinking about how your wealth can be used to help others, then there’s endless upside

Related: The Benefits Of A Revocable Living Trust

8) Enjoy being a middle class American. Reducing the $1 million mortgage indebtedness to $500K, raising the child tax credit to $1,600 from $1,000, limiting the deductibility of property tax to $10,000, raising the income limit to $1,000,000 from $480,000 for married couples until the 39.6% marginal income tax kicks in, and eliminating the death tax doesn’t affect the middle class.

But what does help the middle class is almost doubling the standard deduction, whether you have a property or not, to $12,000 for individuals and $24,000 for families. Roughly 70.4% of taxpayers claimed the standard deduction on their tax return, therefore, most Americans will benefit from the increase. Of those who do itemize their deductions, the average claim for 2014 was $27,447 according to the IRS. Therefore, there is a convergence and a simplification or the tax code.

A $24,000 standard deduction for married couples equates to paying a 2.4% interest rate on a $1,000,000 mortgage. Hence, the increase in standard deduction takes some of the sting out of the potential halving of the mortgage interest deduction to $500,000. That said, property in higher cost areas should still feel downward pressure at the margin because mortgage interest is only one of several itemized items for deduction.

Related: We’re All Middle Class Citizens

Try To Avoid Getting Stuck In The Upper Middle

The GOP tax proposal is telling everybody not to get stuck in the upper middle like garbage in a trash compactor. The people who may lose the most are working individuals making between $200,000 – $416,700 and families making $260,000 – $470,700 living in high tax rate states. These folks may see their marginal income tax rate go up from 33% to 35% and see many deductions disappear.

You either want to make less than $200,000 as an individual or less than $260,000 as a married couple or as close to $500,000 as an individual or as close to $1,000,000 as a married couple. Everything else will either be neutral or slightly negative.

As for me, I plan to generate as much business profits as possible until the next administration arrives. If the business pass through tax rate does get capped at 25%, I will use my tax savings to hire someone to help run the business and write content so I can spend more time with my family. Readers win because I won’t end up quitting under the strain of full-time parenthood for the next five years. The economy wins because one more person gets a job and spends.

I’ve already sold a very expensive property in San Francisco to lock in gains, simplify life, and diversify into heartland real estate. If the mortgage indebtedness cap for interest deduction does decline to $500,000, I will pay down my principal mortgage debt to $500,000 if previous mortgages above the threshold are not grandfathered. Finally, I plan to leave San Francisco and move to Honolulu where the property tax rate is 70% lower within the next three years.

Hopefully by the time tax rates rise again, I’ll be completely sick of making money and want to relax. As a retiree, you want high tax rates so that other people can pay for your benefits. In a low tax rate, bull market environment, it’s best to press as much as possible.

Readers, how do you feel about the latest GOP tax proposal? Will you do anything to take advantage?

The post How To Win Under The Proposed Republican Tax Plan appeared first on Financial Samurai.

No comments:

Post a Comment