If you read about the 1031 exchange, you’ll immediately think it’s the greatest thing on earth for real estate investors. What’s not to like about paying zero capital gains tax after the sale of a property? The government already taxes real estate investors through an annual property tax and a transfer tax upon sale. Having to pay capital gains tax on the way out can be very painful, especially since prices have surged to all-time highs in many areas of the country.

If you read about the 1031 exchange, you’ll immediately think it’s the greatest thing on earth for real estate investors. What’s not to like about paying zero capital gains tax after the sale of a property? The government already taxes real estate investors through an annual property tax and a transfer tax upon sale. Having to pay capital gains tax on the way out can be very painful, especially since prices have surged to all-time highs in many areas of the country.

But I don’t mind paying taxes. After all, taxes help keep our country running. I just mind paying an amount much greater than 30% on gains or income earned. In other words, after you start making over $300,000 as a single person or $500,000 as a couple, based on our current tax rules, it doesn’t make sense to kill yourself at work to make much more.

Making more than $300,000/$500,000 won’t increase happiness because you can buy pretty much anything you want at this level. And since you’re no longer gaining more happiness, you’ll start losing happiness once the government starts siphoning a larger percentage each minute you spend away from your family chasing the all mighty dollar. Trust me, there are plenty of miserable couples making $500,000 a year.

For those on the fence about conducting a 1031 exchange, here are some reasons for not proceeding.

What Is A 1031 Exchange

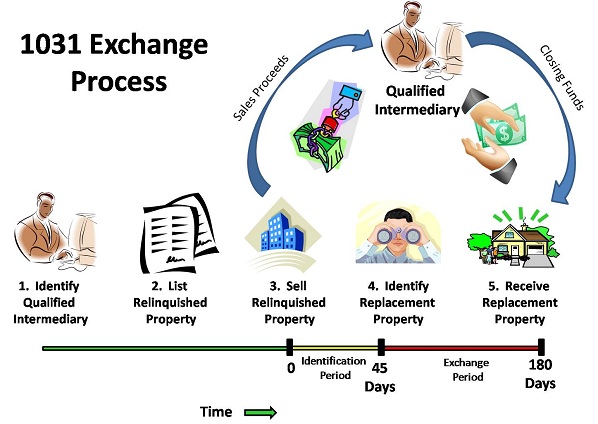

A 1031 Exchange allows an investor to “defer” paying capital gains taxes on an investment property when it is sold, as long as another “like-kind property” is purchased with the profit gained by the sale of the first property.

To do a 1031 exchange effectively, you must exchange one property for another property of similar value. Further, the purchase price and the new loan amount has to be the same or higher on the replacement property.

In my case, I had to find a single family or multi-unit property worth at least $2,740,000. I could find a property worth less than $2,740,000, but then I’d have to pay the capital gains tax on the difference in sale price and purchase price of the new property known as “boot.”

The property owner has 45 calendar days, post-closing of the first property, to identify up to three potential properties of like-kind. After the properties are identified, the investor has 180 days to make the purchase and initiate the exchange OR by the due date of the income tax return with extension, whichever is earlier.

Finally, you’ve got to pay a Qualified Intermediary anywhere from $1,000 – $3,000 to hold your proceeds (you never get to see or touch the proceeds from your home sale) to conduct the exchange. If you are unable to identify and buy a new property, you lose that money and all that time.

Main Reasons Not To Do A 1031 Exchange

* You don’t mind paying taxes

* You haven’t found the right property

* You want to reduce exposure to real estate

* You want to simplify your life

For a guy who wanted to de-risk and simplify life, trading one expensive SF property for another expensive SF property just to save on taxes wouldn’t achieve my goals. I felt a little like I escaped death, having gone through the financial crisis with a huge mortgage, and coming out unscathed. Further, I’m focused on freeing up as much time as possible to take care of my family.

With an equally expensive San Francisco property out of consideration, I looked at Honolulu property, where we’re considering moving back once our son is eligible for kindergarten in 2022. Given Honolulu is cheaper than San Francisco, we’d end up buying an even larger property to manage than the one we have in San Francisco. Or, we could buy our retirement dream home near the beach, but it would have to be rented out for at least one year, if not two years for it to be considered rental property by the IRS.

Dream property in Kailua, Oahu, but this one costs over $15M

Finally, I asked RealtyShares whether they had any properties on their platform eligible for a 1031 Exchange. At the time my house was to close, they said they didn’t, but that something was in the works. About a month after my transaction closed, they sent me an e-mail saying they had launched their first 1031-eligible property, a 272 unit multi-family project looking to raise $4,500,000 in Houston, Texas with an 8-year holding period, and a 13% target IRR.

I’m fine with an 8-year holding period (longer the better so I don’t have to think about redeploying capital and paying taxes), but with $2,740,000 million to put to work, I would take up more than 50% of the deal size. I don’t recommend anybody account for greater than 10% of any deal due to concentration risk. Further, think about how stressed I would be before, during, and after Hurricane Harvey hit.

As I thought about this close call, I realized the primary purpose of de-risking and simplifying life is to minimize stress. Up until my son was born, almost all the stress I had was dealing with maintenance issues and tenants.

I already got rid of work stress in 2012 by negotiating a severance. I got rid of money stress by hitting a net worth target and reaching a passive income goal. Online work is not that stressful because writing comes easy to me and there are only a few truly thoughtless people who like to say unthoughtful things.

From a financial perspective, although the gross gain from selling my rental home was ~$1.22M and ~$1.8M hit my bank account after years of paying down the mortgage, the taxable gain is much less due to the $250K/$500K tax-free gain exclusion, selling expenses, and home remodeling expenses.

For example, theoretically, I could pay no capital gains tax if I spent $600,000 remodeling the house and $150,000 selling my house because when you add the $500K tax-free exclusion, the total is $1,250,000, or more than the gross profit I received.

In this example, the negative of not paying taxes means the gains weren’t much greater than the tax-free gain exclusion amounts. But at the end of the day, I’m left with $1.8M in the bank versus $305,000 when I first put the 20% downpayment in 2005.

I’ve set aside $150,000 for capital gains tax (federal + state) next year, but hope the actual tax bill after deducting all my home remodeling and selling expenses will be much less.

Focus On What’s Most Important

For all of you considering doing a 1031 exchange, consider these thoughts:

1) If you cannot find the right property to reinvest the proceeds, don’t do a 1031 exchange. It would be foolish to try and save on taxes, but then lose principle value because you bought the wrong property at the wrong time in the cycle. You might feel a lot of pressure to identify three properties to purchase in 45 days and pay a bad price because you’ve got to close within 180 days.

2) Don’t let your tax bill dictate your decisions. A large tax bill is usually great because it means you made an even greater profit. I remember plenty of folks during the 2000 dotcom bust who refused to sell their stock after they exercised their options because they didn’t want to pay any taxes. But when their stock eventually went to zero, not only were they left with nothing, they also had to pay a huge tax bill!

3) Focus on lifestyle first, money second. Your real estate investments should serve you, not the other way around. Even if we found our dream home in Honolulu, we wouldn’t move because we don’t want to leave our lifestyle in San Francisco just yet. We just finished completely remodeling our house. We have our doctors we’ve trusted for years and a pediatrician and ophthalmologist we like for our son. We’ve got a set of friends we enjoy hanging with. And we’ve also scoped out and applied to several pre-schools too.

4) Will you really be able to hold on forever? A 1031 Exchange allows you to delay paying your taxes. It doesn’t eliminate your capital gains tax. Only if you never sell your 1031 exchanged property or keep on doing a 1031 exchange, will you never incur a tax liability. You can pass on your property to your children who get to step-up the value to current market value so they never have to pay taxes on your property either. It’s only after your assets exceed the estate tax limit ($5.49M individual, double for a couple) do your heirs need to pay ~40% tax on anything over. The median holding period for property in America is between 7 – 8 years.

5) Do you really need the rental income? A 1031 exchange is exclusively for rental properties, not primary residences. Therefore, the primary reason to own rental property is for income. Income streams can change over time, as they have for us. I thought we would need the rental income forever because we never wanted to go back to work. Little did we know that during the three years we tried renting out the house, our online income grew to the point where we definitely don’t need rental property anymore. Even if our online income was slashed by 80%, we still wouldn’t need any portion of our rental income in our passive income portfolio.

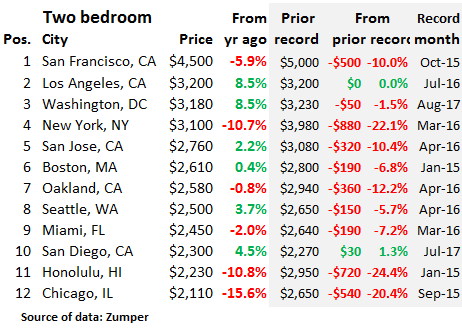

The decline in SF rent in June 2017 when I tried to rent out my house is finally showing up in the data in October 2017.

A Simpler Life Feels Great

In a perfect world, I would have 1031 exchanged all the proceeds into a diversified private real estate fund that returned at least 10% a year forever, guaranteed. Alas, I was unable to find such an opportunity. I’ve already redeployed over half the proceeds in 100% passive investments. The remaining proceeds will more than likely stay liquid in order to finally buy that dream home in Hawaii one day.

Readers, have you ever done a 1031 exchange? How did you decide which property to invest in? Did you set up a 1031 Exchange and end up not following through? If so, why not?

The post Reasons Not To Do A 1031 Exchange To Save On Taxes appeared first on Financial Samurai.

No comments:

Post a Comment