For a guy who likes to thoroughly analyze things, I made a mistake when selling my house that could have cost me hundreds of thousands of dollars. Before accepting the final offer, I failed to do a thorough analysis of what similar homes bought at a similar time for a similar price sold for most recently. Instead, I just looked at current listings, recently sold homes no matter when they were purchased, looked at how the overall median price point moved, took my realtor’s guidance, and went with my gut.

For a guy who likes to thoroughly analyze things, I made a mistake when selling my house that could have cost me hundreds of thousands of dollars. Before accepting the final offer, I failed to do a thorough analysis of what similar homes bought at a similar time for a similar price sold for most recently. Instead, I just looked at current listings, recently sold homes no matter when they were purchased, looked at how the overall median price point moved, took my realtor’s guidance, and went with my gut.

In other words, I extrapolated the overall trend of the real estate market and applied it to my house without finding apples-to-apples comparisons. If the SF housing market was up 50% since 2012, so was mine! I now realize after writing this post why I wasn’t more thorough. I was afraid I wouldn’t like what I found. My house was on a busy street near one of the busiest streets in San Francisco (three lanes each direction). I didn’t want to relive the disappointment when I tried to sell the house in 2012 and failed.

To refresh, I bought a 2,070 sqft, three bedroom, two bathroom single family house with an unwarranted room and bathroom on the ground floor on a 2,300 square foot lot in February 2005 for $1,525,000. I tried to sell the house for $1,700,000 in 2012, but didn’t get a single offer. Finally, I sold the house in June 2017 for $2,740,000 because I no longer wanted to be a landlord.

In this post, I will now do the exercise I should have done before I listed my home. This is an exercise you should do too if you are planning on selling your home. If you don’t want to do it, make your real estate agent do it! You will be amazed at your findings.

Example 1/3: 5 beds, 5 baths, 4525 sqft, asking $2,295,000

This house blows my rental house out of the water in terms of livability, interior quality, house size, and lot size. I’m a big fan of brick facade buildings because they remind me of homes back in Virginia where I lived for eight years.

This house sits on a half acre lot in a gated community with a pool, two outdoor hot tubs, and a gourmet kitchen. The house is located in the town of Moraga, a lovely suburb 22 miles east of San Francisco where the temperature hovers around 70-85 degrees throughout the year. Unfortunately for the seller, the town of Moraga declared a fiscal emergency in 2017 because they’ve got a management crisis.

The public schools in the area are good, and there’s also a nice country club in the town for swimming, golf, and tennis. Every year I come out here to watch for free the Heritage Bank Tennis Open, where ex-pros and college players compete for $100,000 in prize money. This year, I finally started visualizing what the possibilities of suburban living now that I have a son.

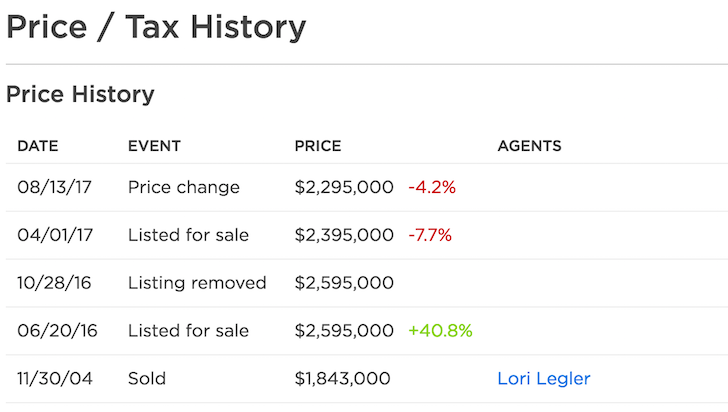

On the financial front, this house sold for $1,843,000 right around the time I bought my SF home for $1,525,000. Now the home is for sale for $2,295,000, after going without an offer at $2,395,000 since April 1, 2017. At the time of this post, the house went into contract August, but then fell out in November 2017.

In other words, this perfectly beautiful home cost the buyer $328,000 more to buy and will net at least $445,000 less than my house IF it sells for $2,395,000. That’s a whopping $773,000 profit difference. Such a difference is astonishing given Moraga is a sought after location where many working professionals who have jobs in San Francisco want to live. All this time I thought the entire Bay Area was inflating at a similar pace. Not so.

Some takeaways: There are relative value opportunities all the time if you look beyond what you are used to. If you can’t afford to buy in the most prime neighborhood, that’s OK! You can probably get way more for the same or less if you’re willing to look. That’s what I did in 2014 when I decided to look for panoramic ocean view homes in the western part of San Francisco. That said, the returns may definitely not be as good.

Before buying, it’s also important to analyze the fiscal health of the town, city, and state. It never would have occurred to me to check a municipality’s finances when its median home price is over $1,000,000. If you have a government that mismanages its finances, you can expect tax increases and/or a cut back in services. See Chicago as a model city for fiscal mismanagement.

https://www.zillow.com/homedetails/15-Merrill-Dr-Moraga-CA-94556/18473921_zpid/

Example 2/3: 3 bed, 2 bath, 1,700 sqft condo in the Marina district, SF

Some of you are thinking it isn’t fair to compare a home in the suburbs with my old rental home in San Francisco even though both homes fit similar demographics. Fair enough. It’s hard finding a home that was purchased at a similar time (late 2004/early 2005) at a similar price point ($1,525,000), but I found another one.

Here’s a lower full-floor condo in the same neighborhood as my house. With three bedrooms, two bathrooms, and 1,700 sqft, the condo is similar in size to my 2,070 sqft home I sold. The target buyer is definitely the same as well. The condo looks to have been remodeled maybe 20 years ago based on the bathroom and kitchen pictures. It’s in a prime block, unlike my house.

The home was purchased for $1,500,000 in October, 2005. Because the market went up about 10% in 2005, let’s say the apples-to-apples cost was $1,410,000 if they had purchased the condo when I closed in March 2005. After being on the market for $1,795,000 since April 6, 2017, the seller lowered the price to $1,750,000 on June 16, 2017 and finally accepted an offer for $1,720,000.

In other words, during the same time period, the property owner only made $220,000, or $1,020,000 less than I made on my home.

One takeaway: Condos, even in better locations, may underperform single family homes because they are more susceptible to large supply increases. We’re now seeing a surge of condo construction in San Francisco that is putting a damper on rental and property prices. New condos are not only competing with older condos, they are also competing with single family homes in a similar price point as demographics shift towards simpler living.

https://www.redfin.com/CA/San-Francisco/3622-Broderick-St-94123/unit-1/home/1227703?utm_source=myredfin&utm_medium=email&utm_campaign=iphone_email&utm_nooverride=1&utm_content=home_image

Example 3/3: 3 bedroom, 2.5 bath, 2,100 sqft single family home in the Marina, SF

OK, so now you’re thinking it’s unfair to compare my single family home to a condo in the same area, even though the size and type of buyer is similar. Fair enough!

I stumbled across a home that is basically my same house, just on a super prime block with little traffic, and very close to the Palace of Fine Arts and the Bay. I spoke to the realtor and he mentioned they put “a good amount of money” into renovating the two bathrooms. They also painted the entire interior, refinished the top floors, and staged the home as well. Based on my home renovation knowledge, I’m guessing they spent about $50,000 fixing everything up, plus $15,000 on staging.

Charming house right? Back in 2004 when I was looking to buy a single family house in the Marina, this was the type of house on a quiet street I wanted to buy. But they were all going for about $1,000/sqft already, which meant this home would have sold for roughly $2,100,000. I couldn’t afford this price point, so I bought a similar house, but on an inferior street for 29% ($600,000) less.

With the way the house was finished and the location, I was guessing the house would go over its $2,995,000 asking by $100,000 – $200,000. This is San Francisco after all, where homes are purposefully priced below market to ignite a bidding war.

What transpired was odd. The home went into pending at $2,995,000 within 14 days of listing, giving me confidence that my pricing assumption was correct. But a couple days before the home closed, the listing price changed to $2,799,000.

I was wondering why this would be the case given the pending status, and I realized why after the home was finally sold for $2,807,000. By changing the asking price to $2,799,000, the realtor and the seller could officially say the home was sold for over asking. Tricky stuff!

I’m honestly very surprised about the final selling price. If you are to use my 29% pricing discount when I bought in early 2005, the home should have sold for closer to $3,800,000 since I sold my home for $2,740,000. Even with a narrowing of the pricing gap to a 15% premium for the far superior location, the house should have sold for at least $3,150,000.

The seller had put in ~$65,000 to prepare the house for sale, while I spent only $4,000 refinishing the floors, fixing the yard, and buying a fancy kitchen faucet. Granted, I did spend eight hours painting two bedrooms and touching up all the moldings, but still. The prep work cost differential along with the 1% higher realtor commission fee the seller had to pay is a lot.

Some takeaways: Be careful over prepping your house for sale. I’ve seen so many cases where the buyer just comes in and rips everything out, like this buyer is doing after I spoke to the contractor who so happened to be outside when I was walking by after sale. Painting, refinishing the floors, updating fixtures, cleaning, and staging is probably good enough if you can sell the dream.

I was told by a top producing realtor that if I spent $50,000 – $60,000 prepping my home I could get “maybe $2,500,000.” He wanted me to paint over my natural brick facade to a dark grey too. Crazy! I then got his opinion on the floor staining color and he told me a dark grey as well. But then he called his interior designer who said a white oak color. Then I talked to another top producer who said to make the stain clear to show off the original floor. Everybody had a different opinion.

Finally, although realtors are absurdly expensive, the right realtor can make all the difference based off his or her connections. There’s only a ~45 day window to sell a property before it becomes stalefish, and the right realtor will be able to maximize exposure to the right agents. All it takes is one perfect buyer to get the deal done. My buyer loved the brick facade of my house because it reminded him of the colonial homes back at UVA, where he went to school. He didn’t mind the vicinity to a busy street and liked that one floor had three bedrooms and two full bathrooms given he has a girlfriend and toddler.

https://www.redfin.com/CA/San-Francisco/2028-Jefferson-St-94123/home/881785

So Many Variables To Buying and Selling A Home

Here are some common recommendations before buying: 1) not buying the most expensive house on the block, 2) buying in the best location possible, 3) buying during the middle of winter, 4) buying from a couple getting a divorce, 5) offering all cash, 6) buying in a fiscally sound area with tremendous job growth, and 7) buying below a certain valuation.

Now that I’ve sold my house, I realize there are more variables that go into getting the best price possible, including a well-connected real estate agent who can find the right buyer and good old fashioned luck.

If I wasn’t fearful of losing my job in Manhattan during the dotcom collapse, I never would have moved to San Francisco in 2001. If I never attended an open house for a three bedroom condo for $1.2M in the winter of 2004, I never would have parked my car next to the house I ended up buying and selling this year. If my rowdy tenants never decided to move out in May 2017, I never would have had the opportunity to test the market. If I never met my realtor at a house she was listing a couple blocks away from new new house a year and a half prior, she never would have found the agent with my ideal buyer.

Luck is easy to find in a bull market. The key is to recognize whether we are in a bull market or not and press if we are and de-risk if there are signs of a slowdown. Don’t forget that often times, money is made on the purchase, not on the sale. To their long term detriment, I see too many emotional buyers pay irrational prices because they just love the kitchen or have been outbid one too many times (examples #1 and #2). A good realtor should be able to walk you off the ledge.

Although it’s best to hold onto your property forever, if you want to sell, you should sell when you don’t have to sell. It’s when you have to sell that you might be screwed because you won’t have as much courage to negotiate and everybody else might want to sell too. Once a downturn hits, the bottom drops out and you’ll see vultures offer way below asking. I experienced this during my unsuccessful listing in 2012 when I was getting whispers for $100,000 below asking.

Finally, all it takes is one buyer to fall in love with the place and pay top dollar. Therefore, it’s worth spending a little longer searching for that one if you can afford to wait.

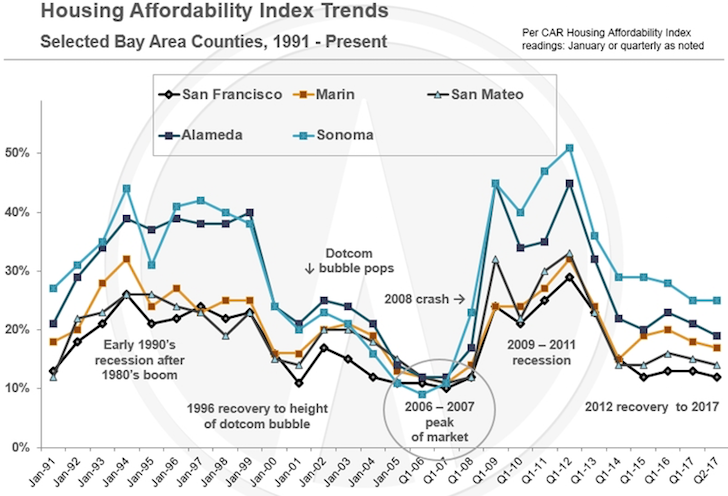

All it takes is a $500,000 household income to afford a $1.5M median priced home in the SF Bay Area

My final realization is that if I did this exercise before getting my initial offer of $2,600,000, I would have gladly taken it and not countered to $2,788,000 before finally settling on $2,740,000. Example #3 selling for $2,807,000 would have implied my house was valued at ~$2,400,000 using a 15% discount.

I’m sure 20 years from now I’ll look back and realize how cheap I sold my home. There’s no doubt in my mind the house will be worth $4M+ by the year 2037. But for the next 12 months at least, I’m feeling good about my sale, especially since I’ve reinvested the proceeds in truly passive investments that take zero of my time and may provide higher returns now that the SF market is cooling.

Readers, any lessons you’ve learned from selling your house? What are some surprises you found out before or after selling? What are some other things home sellers should consider before listing?

The post What Every Home Seller Should Do Before Listing A House On The Market appeared first on Financial Samurai.

No comments:

Post a Comment