Hopefully everyone got some laughs this April Fool’s! It’s always good to poke fun at yourself once in a while to stay grounded. Yes, Twitter is indeed like high school where there are gang ups, non-stop gossiping, and outbursts of hormonal rage. One of the main reasons why Disney decided to back out from their purchase of Twitter was due to the fear that all the hate would spill over and tarnish its reputation.

Hopefully everyone got some laughs this April Fool’s! It’s always good to poke fun at yourself once in a while to stay grounded. Yes, Twitter is indeed like high school where there are gang ups, non-stop gossiping, and outbursts of hormonal rage. One of the main reasons why Disney decided to back out from their purchase of Twitter was due to the fear that all the hate would spill over and tarnish its reputation.

Anyway, I stand by my belief that if you are a happy person with a healthy dose of self-esteem, it’s hard to tell others to f off once you have f you money. Money simply magnifies who you already are. Let’s show empathy to the ones who dislike us the most.

For 2018 and beyond, I’ve decided to do things a little differently by taking away the absolute dollar amounts I invest. Given that there’s been so much rage against the middle class in expensive coastal cities, I don’t want the numbers to be a distraction. Only my family cares about how much we invest anyway.

1Q2018 Investment Update And Outlook

Stock Market

After rising as much as 7.22% in January, the Dow and S&P 500 closed down ~4% for after April 2. The initial ascent was unsustainable since such continued performance would lead to an annualized gain of over 100% for the year after a strong 20% in 2017.

Unfortunately, the government is no longer a tailwind, but a headwind with the start of trade wars with China and other countries. It’s now all about protecting special interest groups and asserting one’s dominance over others. It will be interesting to see if Trump can survive full-term if the stock market continues to falter.

Tech is out of favor at the moment after a huge data breach at Facebook, Uber’s self-driving car killing a woman in Arizona, another Tesla crash on autopilot with negative talks about Model 3 production, and Trump going after Amazon for not paying enough taxes (Financial Samurai pays more corporate income tax than Amazon).

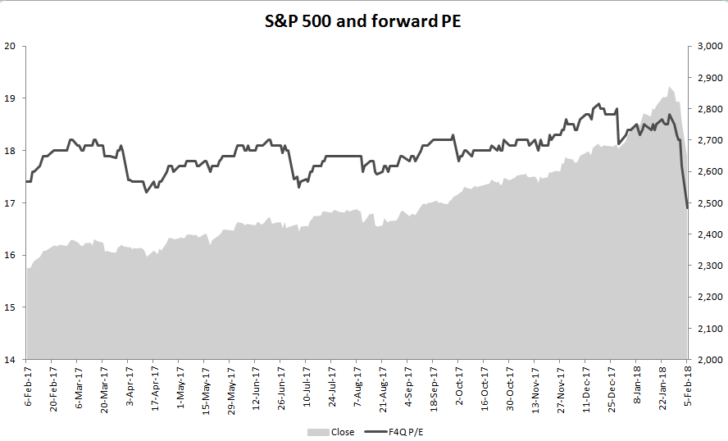

With the S&P 500 down about 11% from its peak and having tested its bottom again in March, the market is trading at about ~16.8X 12-month forward estimated earnings. Prior to the selloff, the S&P 500 was trading at 18.2 times expected earnings, pricey compared to its 10-year average of 14.5. In December, the S&P 500’s forward PE reached as high as 18.9 before analysts began to increase their estimates for companies reporting their fourth-quarter results.

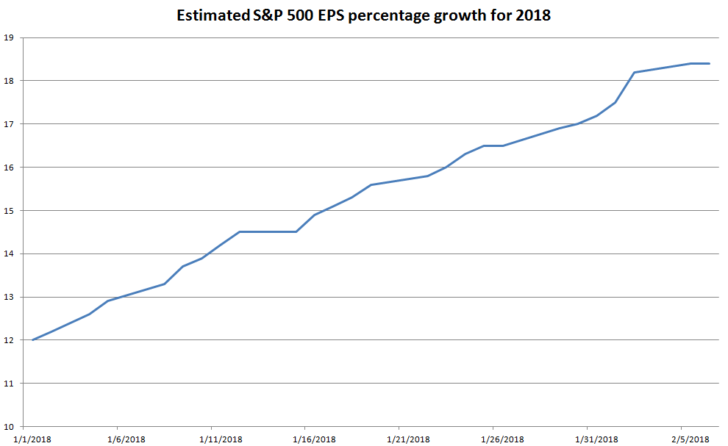

Therefore, even at ~16.8X forward P/E, the S&P 500 is not cheap compared to historical averages. However, if earnings grow by an estimated 18.4% over the next four quarters, you’ve got a P/E to Growth (PEG) ratio of less than 1X, which seems reasonable if the world can get along.

Source: Thomson Reuters I/B/E/S

Source: Thomson Reuters I/B/E/S

The best way I see the stock market regaining its footing is by companies reporting solid 1Q2018 results in 2Q. We’ve been whiplashed around by news and government rhetoric. If the majority of companies in the S&P 500 can meet or beat earnings expectations, then the expectations for an 18.4% S&P 500 earnings growth estimate will become stronger. If this happens, confidence will return to the stock market since stocks trade on earnings fundamentals at the end of the day.

I deployed a fourth of my remaining house sale proceeds at the beginning of the year, another fourth in February after the meltdown, and another fourth at the end of March when we hit a “double bottom.” I invested the rest of my house proceeds + cash flow into the bond market, which we’ll talk about next.

Stock Market Outlook At Current Levels: 7/10. I estimate 10% further downside at most and 15% upside if everything falls into place. I always look at investments with a risk / reward ratio.

Bonds Market Overview And Outlook

With fiscal stimulus and tax cuts, the market decided that such moves would be highly inflationary. Bonds sold off as a result, causing bond yields to rise and stocks to fall.

My line in the sand for the 10-year bond yield is 3% for 2018. It came close to breaching 3% when we got up to 2.94% on February 21. But yields have since come back down to around 2.73% with all the turmoil going on in the stock market.

Although the Aggregate Bond Market Index is down about 1.2% for the year, that’s better than being down 4% in the S&P 500. We might be in a situation this year of what asset classes loses me the least. But it’s too early to tell. Even if bonds end up down 2% for the year, you’re still up 0.75% if the yield is 2.75%.

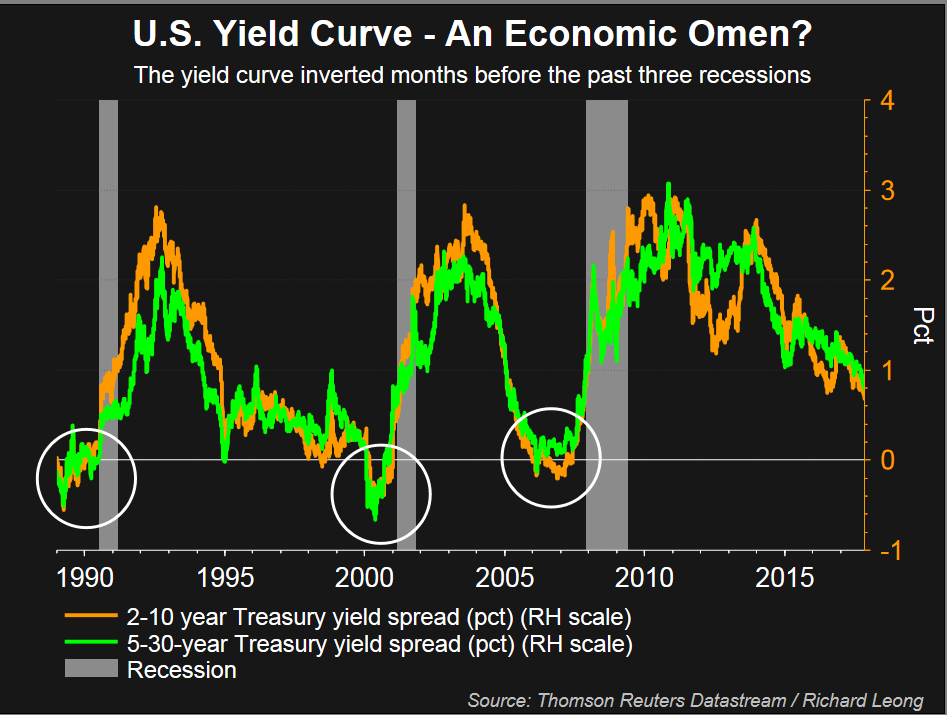

I’m sticking with my belief that the 10-year bond yield does not breach 3% for 2018. Even if we do, it won’t be for very long (less than a couple weeks). In other words, the yield curve will continue to flatten if the Fed does not slow down its rate hikes, providing an ominous sign that a recession is coming.

Given the Fed isn’t stupid, I’m confident they will adjust their rate hike count and amount if the labor market weakens, inflation comes under expectations, and the stock market continues to correct.

I bought California muni bonds and some longer term treasury ETFs at the end of February after the 10-year yield broke 2.9%. A 3% muni bond yield is equivalent to a 4.3% gross yield if you have a 30% effective tax rate. A 4% gross yield has always been my post-work retirement target return.

Bond Market Outlook At Current Levels: 6/10. 1-2% downside, 3%-4% upside. When the 10-year yield was at 2.94%, I would give the bond market outlook a 8.5/10, but the yield has since come down.

Real Estate Market Outlook

One of the good things about global uncertainty is that investors seek the security of bonds, thereby lowering bond yields. With the 10-year bond yield coming off its highs, the real estate market may not get squeezed as hard as it could. That said, we are still ~45 basis points higher than we were in December 2017, so debt servicing is more expensive.

I continue to be very cautious about expensive coastal city real estate. Unless you are super bullish about your career prospects, have a massive liquidity event, have at least 30% of the value of the house you want to buy in cash (20% down, 10%+ cash buffer), or are starting a family plus at least one of the things I just mentioned, I would not be buying coastal city real estate, especially if you don’t plan to own the property for 10+ years.

See: It Feels A Lot Like 2007 Again: Reflections From The Previous Top Of The Market

Pricing pressure generally starts at the top and works its way down. Beware.

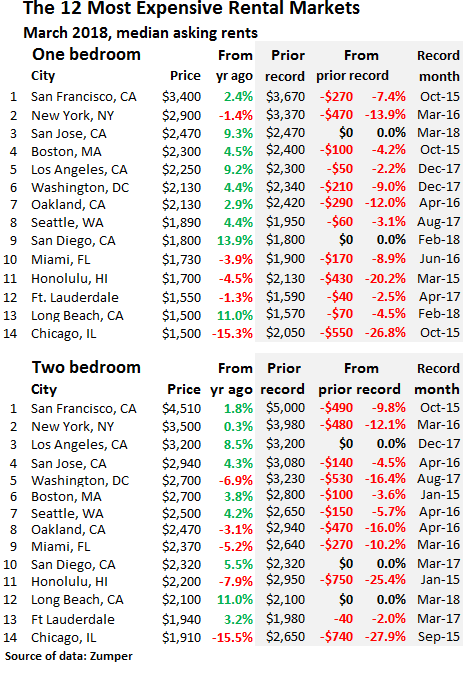

The risk reward for leveraging up at current valuations is unwise for the average person. Rents are falling in places like New York City, San Francisco, and Honolulu. With more supply in Seattle coming online than any other time in the past, Seattle rents are also starting to soften.

Please read BURL: The Real Estate Investing Rule To Follow, if you haven’t done so already.

If earnings fundamentals are important to you, as they should be, the price you decide to pay for your property should be equivalent to the price from the record month MINUS the rental price change since that time period. In other words, if you are planning to buy a 2-bedroom apartment in Honolulu this year, look up what the price of a comparable apartment was in January 2015 and subtract 25%. That price will give you a rough idea of where you should offer or counter offer.

Now is the time to be picky and negotiate, not be the foolish winner of a manic bidding war.

As for non-coastal city markets, they’ve got farther to run due to lower valuations and stronger demographic trends. That said, each market is different, and eventually, their waves will also crest. Focus on demographics because some places like Denver and Dallas have gone bonkers.

The stock market should give real estate investors some insight into the future. Look at sectors that are heavy in the city and state you want to buy and see how they are doing. Stocks reflect future earnings, and if earnings are at risk, so is job growth, wages, and housing demand.

Geo-arbitrage within the United States is going to be a multi-decade trend, which is why I’m investing in the heartland of America.

Housing Outlook For Expensive Coastal Cities: 3/10

Housing Outlook For Non-Coastal Cities: 7.5/10

Alternative Investments

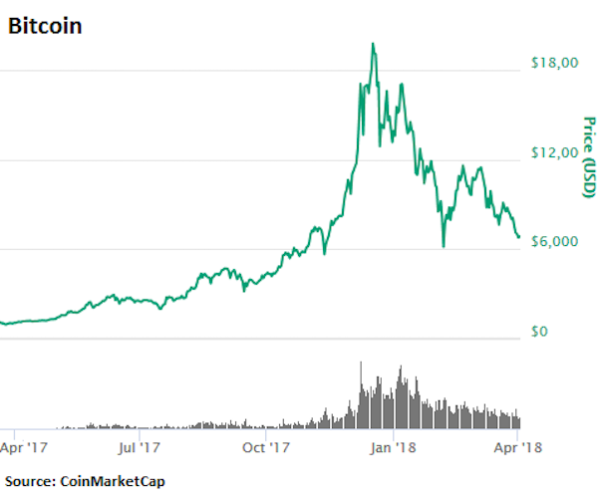

Even though many investments are struggling in 2018 so far, there’s one investment that has struggled the most: cryptocurrencies! It was absolute carnage in the space. Names like Bitcoin, Ethereum, and Ripple are all down 50%+ for the quarter, so don’t feel bad if you’re down single digits in the stock market.

The collapse of cryptos is a great reminder to keep your alternative investment exposure limited to what you can afford to lose. For me, I keep all alternative exposure to no more than 10% of net worth.

One interesting note, I did have a long conversation about cryptos with a multi-billionaire a couple weeks ago who believes the crypto space will be completed diluted with an endless supply of new cryptos, partially because his company will easily enable all his customers to create their own.

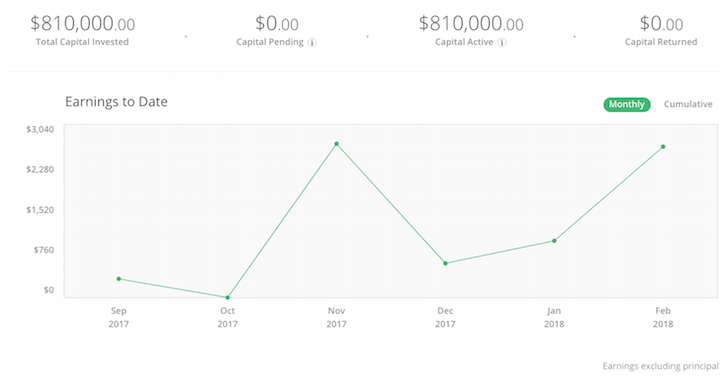

Elsewhere, I was surprised to get a $2,623 payout from RealtyShares in February, since I’ve been modeling only ~$9,600 for the entire year in my 2018-2019 passive income estimates. I haven’t received any notification yet for March as it usually takes a couple weeks after month end to update, but I’ll update the chart once the numbers come out.

At the moment, investing $300,000 in real estate crowdfunding in December 2017 looks like the right choice. I’ve got a total of 17 different investments, the large majority of which I like. But it will take years to find out how well they do given all my investments are equity deals.

With the sale of my SF rental house and the sale of my private gin investment to Campari in 2017, I tried to keep my income as low as possible since the sales shoved me into a higher marginal tax rate before expenses. For 2018, I don’t expect to see another large windfall, hence I’m more open to earning more this year, especially since taxes have declined.

I’ll update this chart once March figures hit

Risk Control Is Paramount

You must go through your net worth asset allocation and do an honest assessment of your risk exposure. Do not be caught with your pants down at a highway rest stop. Predators come out. So long as you know how your money is being allocated and have a plan for what to do in different scenarios, you will go through life with much less financial stress.

As for me, I still feel good reducing ~$815,000 (mortgage) worth of risk exposure in 2017 and diversifying the house proceeds into various other investments. I’m actually considering selling my remaining SF rental given the last piece of avoidable stress in my life is dealing with a power-tripping HOA that has hired a terrible property manager as its minion. They hate landlords.

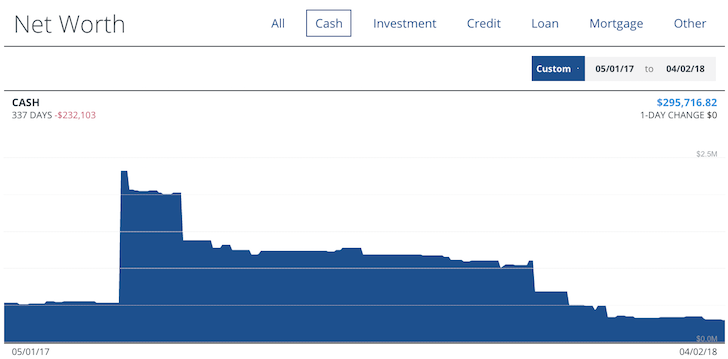

After verifying with my Personal Capital dashboard, I’ve got about $295,717 in cash left. It’s a little deceiving because $185,000 of the balance is from a CD which is coming due at the end of April. The CD was paying 3%, and I’m sad to see it go. At the same time, given asset prices are finally pulling back and interest rates have also moved up, the timing for reinvesting the proceeds is better.

Further, I’ve got to pay tens of thousands of dollars in extra taxes to support this great country of ours! Once I pay my tax bill I’m going to come up with a cash accumulation + investment game plan once again. This year is too tricky not to be on point.

I’d love to hear your thoughts about the stock market, bond market, and real estate market. Would you be happy with a 3% – 4% return in 2018 given all that’s gone on so far? Please invest at your own risk. Every investment decision you make is yours to keep. Related: Things To Do Before Making A Single Investment

The post Financial Samurai 1Q2018 Investment Update And Outlook appeared first on Financial Samurai.

No comments:

Post a Comment