If you decided to sell your house to simply life, lock in gains, downsize, or relocate for a job, this article will help you minimize your tax bill.

If you decided to sell your house to simply life, lock in gains, downsize, or relocate for a job, this article will help you minimize your tax bill.

According to the IRS, most home sellers do not incur capital gains due to the $250,000 and $500,000 exclusion for single and married couples. This makes sense since the median home price is roughly $210,000 in 2018.

There are three tests you must meet in order to treat the gain from the sale of your main home as tax-free up to $250,000 / $500,000:

- Ownership: You must have owned the home for at least two years during the five years prior to the date of your sale. It doesn’t have to be continuous, nor does it have to be the two years immediately preceding the sale.

- Use: You must have used the home you are selling as your principal residence for at least two of the five years prior to the date of sale.

- Timing: You have not excluded the gain on the sale of another home within two years prior to this sale.

But let’s say you plan to sell a property in an expensive coastal city where your gains are much greater than $250,000 / $500,000. There’s a good chance you still won’t owe much in capital gains tax if any if you keep proper records.

How To Minimize Your Capital Gains Tax Bill

If you have greater than a $250,000 / $500,000 capital gain, the title company will most likely send you a 1099-S which tells the IRS the final sale price of the home plus any real estate taxes you may have paid. In other words, you must file a 1099-S when doing your taxes, just like how you must file a 1099-MISC for every freelance job you work.

If you haven’t received a 1099-S, call the title company and ask for one so that your records and the IRS’s records match. While you’re at it, ask the title company for the HUD-1 settlement statement or Closing Disclosure from when you purchased your home and for how much. You want to make sure you have the proper date and cost basis in place for when you do your taxes.

Now that you have these important statements it’s time to dig deep into your records to find out how much you spent on construction, renovation, improvements and any special assessments you’ve paid for local improvements. All these expenses INCREASE your cost basis, thereby DECREASING your capital gains and your capital gains tax.

The problem many long term homeowners encounter is NOT keeping proper records of all their expenditure over the years. It’s hard to remember exactly how much you spent remodeling a bathroom 30 years ago. And often times, the company who did work for you may have gone out of business. Hence, contact all your vendors today even if you don’t plan to sell your house for a while.

Always take pictures of each receipt and keep a spreadsheet of all your home improvement work. The spreadsheet should include a date for when work was completed, the description of the work, the vendor, and the cost.

Example Of A Large Home Sale Gain With A Small Tax Liability

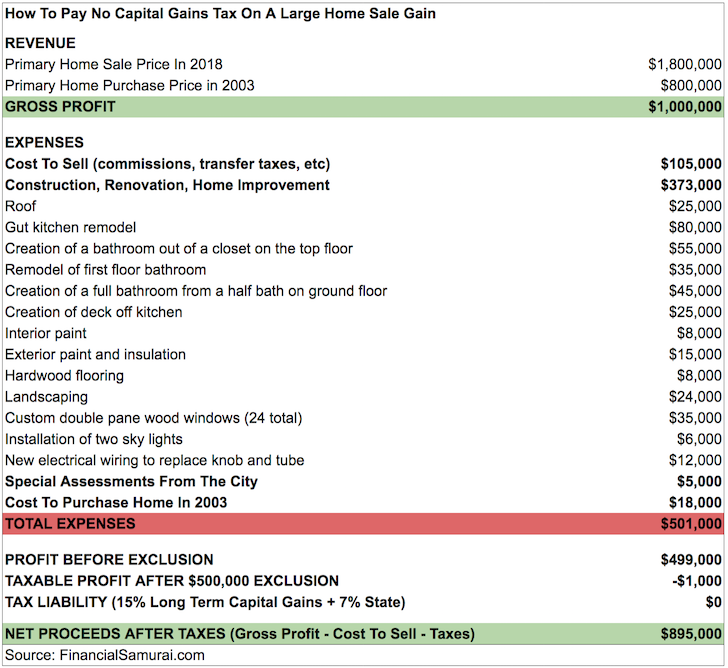

Here’s an example of a $1,800,000 home sale that was originally purchased for $800,000 in 2003. This price appreciation is quite typical in expensive coastal cities like SF and NYC. Despite a handsome $1,000,000 gross profit, the home seller pays $0 federal and state capital gains tax. Study the chart carefully, and let’s discuss the line items below.

Cost to sell: Despite negotiating a total commission cost of 5%, it still costs an absurd $105,000 to sell this $1,800,000 home due to commissions, inspection, 3R and NHD reports, staging, water compliance, and transfer taxes. The transfer tax is particularly arbitrary and onerous for higher priced homes because it is based on a percentage of the selling price, e.g. NY City realty transfer tax: 1% to 2.625% based on +/-$500K home value and type of property. Just remember that the costs to sell a home are negotiable between the real estate agent and the homebuyer.

Related: How Much Does It Cost To Sell A Home

Construction, renovation, and home improvement cost: Over a 15 year time period, this homeowner spent $373,000 making their home perfect. It feels wonderful living in a completely remodeled home compared to an aging rental, especially as your wealth and tastes grow over time. Further, almost all the costs are deductible. This is where having records of all your costs over the years is so important.

Related: If You Want To Make Money On Property, Focus On Expansion

Special assessments from the city: $5,000 was assessed by their city to pay for a water treatment plant overhaul and water sewage pipe replacements.

Cost to purchase the home in 2003: Typically, home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees. This homeowner paid 1 percent of the purchase price in closing fees due to some negotiating. Here are some typical fees homebuyers may face.

- Application Fee: This fee covers the cost for the lender to process your application. It can often include things like a credit check for your credit score or appraisal as well.

- Appraisal: This is paid to the appraisal company to confirm the fair market value of the home.

- Attorney Fee: This pays for an attorney to review the closing documents on behalf of the buyer or the lender. This is not required in all states.

- Closing Fee or Escrow Fee: This is paid to the title company, escrow company or attorney for conducting the closing. The title company or escrow oversees the closing as an independent party in your home purchase. Some states require a real estate attorney be present at every closing.

- Courier Fee: This covers the cost of transporting documents to complete the loan transaction as quickly as possible.

- Credit Report: A Tri-merge credit report is pulled to get your credit history and score. Your credit score plays a big role in determining the interest rate you’ll get on your loan.

- Escrow Deposit for Property Taxes & Mortgage Insurance: Often you are asked to put down two months of property tax and mortgage insurance payments at closing.

- FHA Up-Front Mortgage Insurance Premium (UPMIP): If you have an FHA loan, you’ll be required to pay the UPMIP of 1.75% of the base loan amount. You are also able to roll this into the cost of the loan if you prefer.

- Flood Determination or Life of Loan Coverage: This is paid to a third party to determine if the property is located in a flood zone.

- Home Inspection: You will likely get your own home inspection to verify the condition of a property and to check for home repairs that may be needed before closing.

- Homeowners’ Insurance: This covers possible damages to your home. Your first year’s insurance is often paid at closing.

- Lender’s Policy Title Insurance: This is insurance to assure the lender that you own the home and the lender’s mortgage is a valid lien, and it protects the lender if there is a problem with the title. Similar to the title search, but always a separate line item.

- Lead-Based Paint Inspection: Covers the cost of evaluating lead-based paint risk.

- Loan Discount Points: “Points” are prepaid interest. One point is one percent of your loan amount. This is a lump sum payment that lowers your monthly payment for the life of your loan.

- Owner’s Policy Title Insurance: This is an insurance policy that protects you in the event someone challenges your ownership of the home. It is usually optional.

- Origination Fee: This covers the lender’s administrative costs. It’s usually about 1 percent of the total loan but you can sometimes find mortgages with no origination fee.

- Pest Inspection: This fee covers the cost to inspect for termites or dry rot, which is required in some states and required for government loans.

- Prepaid Interest: Most lenders will ask you to prepay any interest that will accrue between closing and the date of your first mortgage payment.

- Private Mortgage Insurance (PMI): If you’re making a down payment that’s less than 20% of the home’s purchase price, chances are you’ll be required to pay PMI. If so, you may need to pay the first month’s PMI payment at closing.

- Property Tax: Typically, lenders will want any taxes due within 60 days of purchase by the loan servicer to be paid at closing.

- Recording Fees: A fee charged by your local recording office, usually city or county, for the recording of public land records.

- Survey Fee: This fee goes to a survey company to verify all property lines and things like shared fences on the property. This is not required in all states.

- Title Company Title Search or Exam Fee: This fee is paid to the title company for doing a thorough search of the property’s records. The title company researches the deed to your new home, ensuring that no one else has a claim to the property.

- Transfer Taxes: This is the tax paid when the title passes from seller to buyer.

- Underwriting Fee: This also goes to your lender, covering the cost of researching whether or not to approve you for the loan.

Phew! That’s a lot of fees. No wonder why the real estate market has powerful lobbyists to keep transaction costs high. In hot real estate markets, some homebuyers will skip the home inspection, appraisal fee, origination fee, pest inspection, application fee and more because they are paying cash and need to make their offer as competitive as possible.

Profit before exclusion: Without the $500,000 tax-free profit exclusion for married couples, the home seller would have to pay taxes on $499,000 in capital gains. At an 22% total effective tax rate, we’re talking $109,780 in taxes. If the couple was in the top marginal tax bracket, they would have had to pay a 20% federal tax rate + 13% state tax, or $164,670 in taxes. But thanks to the tax-free profit exclusion and all the costs associated with the home, the tax liability is $0.

Net proceeds after tax: The seller walks away with $895,000 in net proceeds, which is fantastic considering the seller put down only $160,000 in 2003. Of course, the home improvement expenses cost them $373,000 over a 15 year time period, but they gained tremendous lifestyle value. If we add the downpayment to the home improvement costs, the home seller still comes away $362,000 richer while having lived in an awesome home all those years.

Compare a $362,000 gain with a $1,080,000 loss if you were to rent the house for $6,000 on average for 15 years. That’s a $1,442,000 swing! Now you can see the wealth building power of homeownership over time. Hopefully, the renter invested their cash flow wisely during this time frame.

Related: Why Real Estate Will Always Be More Desirable Than Stocks

Adjust Your Income And Expenses If You Plan To Sell

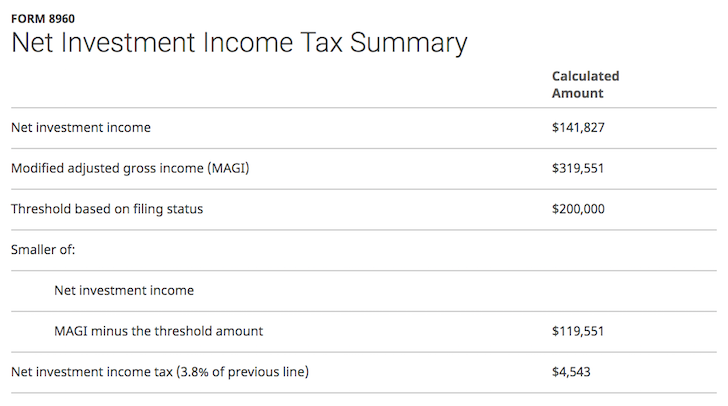

If you plan to sell your home in the near future and know you will likely have a large capital gain, then it’s best to make as little W2 or 1099-MISC income as possible. Once a couple’s income is over $250,000, they’ve got to pay an additional 3.8% Net Investment Income tax (Form 8960) on every dollar above $250,000, as well as the higher marginal income tax rate. The income threshold is $200,000 if you are single.

Here’s an example where a single person made $141,827 in net investment income from his home sale and various stock sales and $167,724 in W2 and 1099-MISC income for a total MAGI of $319,551. Given the income threshold is $200,000, he has to pay an additional 3.8% NII tax on $119,551, or $4,543. What a bummer.

If this individual did more proper planning, during the house sale year, he could have worked less, increased his business expenses, pushed out his 1099-MISC freelance income to the following year, asked for his December paycheck to be paid in January, and deposited as many freelance paychecks in the following year as well.

Business owners have much more flexibility in adjusting their income than day job workers, which is why I encourage everyone to start their own.

Other Considerations

If your property sale was a rental property, then you can consider doing a 1031 Exchange where you defer capital gains tax indefinitely. But for a primary residence, understanding the tax laws and keeping great records are what will save you a ton in capital gains tax when it comes time to sell.

With a large financial windfall, you can utilize the proceeds to buy a nicer home in a lower cost area of the country or world. If not, you can reinvest the proceeds in completely passive investments and rent to keep things simple.

Just remember that you can take advantage of the $250,000 / $500,000 tax free profit rule every two years until the rule changes. Thank goodness the government is on the homeowner’s side.

Readers, do you think it’s unfair that a home seller can pay no tax on a $1,000,000 gain? Are you more inclined to remodel and enjoy a nicer home after seeing this example? Why are people still against homeownership with so many tax advantages? What is missing or needs fixing in my chart example?

The post How To Pay No Capital Gains Tax After Selling Your House For Big Profits appeared first on Financial Samurai.

No comments:

Post a Comment