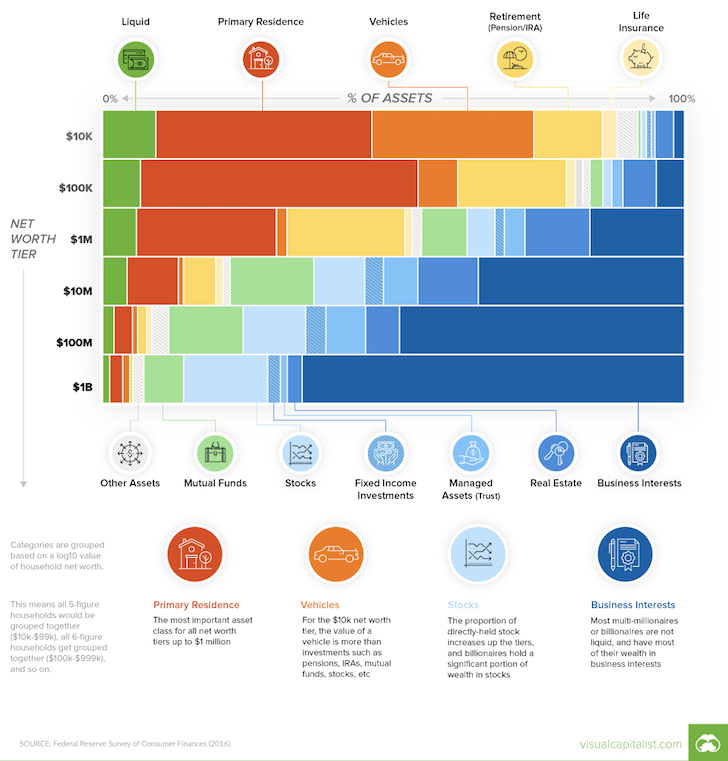

Ever wonder how net worth compositions change the wealthier you get? Look no further as I stumbled across this great chart from VisualCapitalist.com that highlights how much each asset is as a percentage of net worth at various levels. If you want to get rich, it’s good to study how the rich allocate their money.

Notice how red (primary residence) quickly shrinks the wealthier you get while blue (business interests) quickly grows. The key to creating great wealth is to therefore build a business or acquire a significant share of equity in a business.

Net Worth Composition Discussion

Let’s discuss each asset class in a little more detail. I think most Financial Samurai readers or people looking to achieve financial independence are targeting net worth amounts between $500,000 – $10,000,000. Therefore, my commentary is tilted towards this net worth range.

Liquid: As your net worth grows, you don’t need to maintain the same percentage of liquidity to survive through difficult times because the absolute amount of your liquidity increases. The only reason you would need a large percentage of your net worth in liquid assets is if you are highly leveraged. Shoot for 5% – 10% of your net worth in Liquid assets.

Related: The Need For Liquidity Is Overrated

Primary Residence: Notice how there is no asset category for Rent because Rent is a net worth drag. Everybody needs to figure out the right time to own their Primary Residence to at least stay neutral inflation. I’m surprised the Primary Residence category doesn’t take up an even greater percentage of net worth in the $100,000 and $10,000 net worth levels. During the financial crisis, so many Americans got obliterated because their Primary Residence was such a dominant portion of their net worth. I’d get your Primary Residence down to 10% – 30% of your net worth.

Related: Why Real Estate Will Always Be More Desirable Than Stocks

Vehicles: Like Primary Residence, the Vehicle percentage also declines rapidly as one’s net worth grows. Vehicles are the most common net worth killer in my opinion. For some reason, Americans have a love affair with cars and trucks. With the median price of a new car at about $36,000 after tax, the typical American is spending the majority of their ~$59,000 gross household income on a car. Please don’t spend more than 1% – 5% of your net worth or 1/10th of your gross income on a car.

Retirement (Pension/IRA/401k): Only a minority of Americans are now eligible for a pension. But for those who do have a pension, its value is much greater than you might realize. Given the contribution limits to a IRA and 401k, it’s hard for Retirement to grow into a significant portion of one’s net worth.

What’s interesting about the data in the chart is that those with a $1,000,000 net worth have the largest percentage of their net worth in Retirement. Therefore, if you’re amenable to finishing work as a “run of the mill millionaire,” you should strive to max out their pre-tax retirement plans for as long as they work and treat it as bonus money once you are eligible to withdraw funds penalty free.

Related: How Much Should I Have In My 401(k) By Age?

Life Insurance: The fact that Life Insurance is one of the designated asset classes in the chart shows its importance in financial security. Many employees get Life Insurance as a default benefit from work. But often the amount is not enough to fully cover all liabilities. Term Life insurance is cheap before the age of 35 if you are healthy. I highly encourage readers to lock in a long-term policy before a health issue occurs that jacks up your rates.

Related: How Much Life Insurance Do I Really Need?

Mutual Funds: I’m surprised Mutual Funds has the largest weighting for those in the $10,000,000 net worth level. If Mutual Funds are defined as actively run funds with high fees, then digital wealth advisors should channel their efforts towards these high net worth individuals.

Stocks: It’s also interesting to see how Stocks increase as a percentage of net worth the wealthier one gets. Perhaps there’s a higher level of knowledge or conviction as wealth grows. But I suspect the real answer is that wealthier individuals have a greater percentage of net worth in their company stock.

Related: The Benefits Of Stocks Over Real Estate

Fixed Income: Despite the Fixed Income Market being much larger than the Stock Market, it’s surprising to see how little the Fixed Income weighting is across all wealth tiers. One can make the assumption that Fixed Income is an uninspiring tool to stabilize wealth, and can be considered a Liquidity+ investment.

Related: The Case For Bonds: Living For Free And Other Benefits

Managed Assets (Trust): It makes sense that the $10 million and $100 million levels have the highest percentage attributable to Managed Assets. It used to be that you could pass down all your assets estate tax free up to $11 million. But due to tax reform, that number has doubled to $22 million.

Real Estate (rentals/vacation properties): Notice how Real Estate has the largest weighting for those in the $1,000,000 net worth group, but drops off with higher wealth levels. In other words, Real Estate is one of the easiest ways to boost wealth to $1,000,000, but becomes less desirable as time goes on due to maintenance, hassle, and ongoing property taxes. I used to think Real Estate was the best asset class on Earth until I discovered web properties.

Related: A Guide To Buying And Managing Rental Property

Business Interests: Finally, we arrive at the key to building a fortune.

The new CEO of Uber reportedly got a compensation package of around $200 million. He didn’t have to come up with the idea, raise funds, and grind away for years for that type of money. All he has to do is be a good ambassador until he can sell all his stock after the company goes public. The current CEO of Google just sold stock worth $131 million and is getting another $340 million package.

Or, you can go the hard, but extremely satisfying route of creating your own business. The business doesn’t have to be based around a revolutionary new product. Instead, you can simply build a business around a lifestyle like Financial Samurai.

In 2010, I asked myself whether I’d rather own a lifestyle business that one day pumped out $250,000 a year in free cash flow with only 3 hours of work a day and minimal stress or shoot for a 20% chance of getting a $25 million payout by working 14 hour days and experiencing maximum stress for three years. I decided the lifestyle business was the way to go because money doesn’t buy happiness once you make more than $250,000 a year in an expensive ity back then.

When you own a business, not only do you collect its profits, you can also sell the business for a multiple of its profits. This is where the illiquid portion of Business Interests comes in. I’ve been approached a number of times since 2014 to sell, and each time I pass because I want something to do, especially now that I’m a stay at home dad.

Related: Top 10 Reasons For Starting An Online Business

A Different Mindset

I was speaking to a very wealthy entrepreneur the other day, and he said the greatest skill one can have is figuring out a way to hire talented people willing to dedicate their lives to making YOU rich. Of course you will have to properly compensate them, but it is these people who have confidence in themselves, but not enough confidence to make themselves rich through entrepreneurship who you want working for you.

Know your worth. If you are starting to get frustrated with the lack of efficiency at the office or you beginning to tell yourself that you can do it better, then give it a go. Make a better mousetrap.

When I started Financial Samurai in 2009 I found ZERO personal finance blogs written by people who worked in finance. They were all written by people trying to get out of debt or by engineers trying to optimize their content for credit card sign ups. What an opportunity to fill a void!

The people who get really rich are those who ask themselves, “Why not me too?” They believe they deserve to be rich and take action to make it happen.

Related: Sorry Bankers, Techies, And Doctors, You’ll Never Get Rich Working For Someone Else

Readers, how has your net composition changed the wealthier you’ve become? Why don’t more people build a business online given it’s so cheap and easy to start nowadays? Why do some of the most decorated resumes settle for making someone else rich rather than spending all their time making themselves rich?

The post Net Worth Composition By Levels Of Wealth: Build A Business Already appeared first on Financial Samurai.

No comments:

Post a Comment