Recently a long-term CD of mine expired with a 3% interest rate. Although it would have been much better had I invested the money in the stock market years ago, I’ve always aimed to consistently invest 5% – 10% of my net worth in risk-free to near risk-free investments so I’ll never have a liquidity crunch. Taking advantage of a bull market is what the other 90% – 95% of my net worth is for.

Recently a long-term CD of mine expired with a 3% interest rate. Although it would have been much better had I invested the money in the stock market years ago, I’ve always aimed to consistently invest 5% – 10% of my net worth in risk-free to near risk-free investments so I’ll never have a liquidity crunch. Taking advantage of a bull market is what the other 90% – 95% of my net worth is for.

Once you’ve got a nice buffer, you’re more free to take on risks in your investments, career, or business. And sometimes, those big risks pay off in spades. Think about it. What type of moves would you make if you knew you wouldn’t end up in abject poverty thanks to your savings buffer?

Maybe you’d be more willing to negotiate a raise and a promotion without fear of rebuke? Maybe you’d be more willing to join a promising startup for less pay, but more equity upside? Or maybe you’d have more courage to negotiate a severance to start your own business.

In my case, having risk-free investments gave me the courage to leave my job in 2012, buy a 3rd SF property in 2014, and start a family in 2017.

Reinvest Ideas For CD Proceeds

When it comes to investing, it’s important to compartmentalize your money for maximum purpose. After all, if there is no objective, then there’s no reason to delay consumption now instead of waiting for some future greater reward.

The purpose of CD money is so that you can:

* Sleep better

* Have guaranteed money up to $250,000 / $500,000 per individual / married couple

* Keep up with inflation

* Maximize your cash return

* Always have a slug of cash coming in if you set up a CD ladder

* Better cash management for large future expenses e.g. buying a house, paying for college, etc.

Nobody is buying a CD to get rich. Now that we’ve gotten the purpose of CD investing out of the way, let’s discuss some logical reinvestment ideas for your CD proceeds.

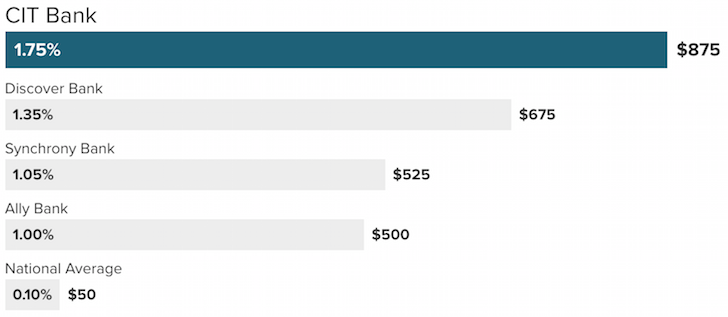

1) Online cash savings account. Although savings accounts still are pitifully low and haven’t followed the Fed Funds rate upward, you should be able to earn at minimum a 1% return with an online cash savings account. Online banks provide higher rates than banks that have a massive bricks and mortars presence due to lower overhead costs. There’s always some reputable bank out there that’s looking to build up its deposits by providing higher rates. At the moment, it looks like CIT Bank has one of the highest money market rates at 1.75%.

Interest rate example with $50,000 deposit

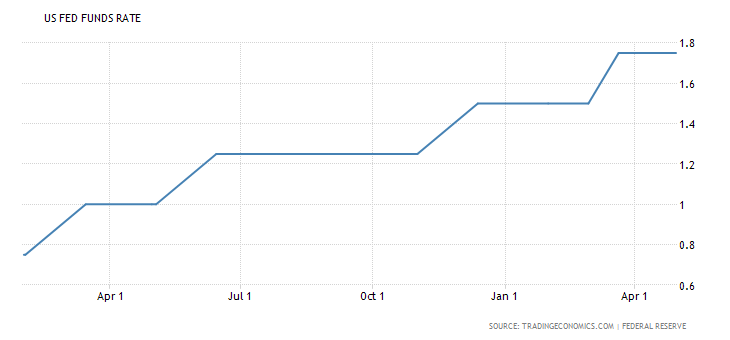

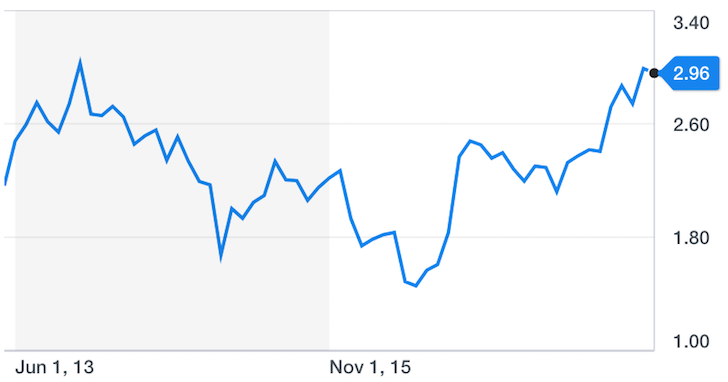

Below is a chart of the latest US Fed Funds rate progression. Given the Fed Funds rate is on the shortest part of the duration curve, your online savings rate should mirror the Fed Funds rate. Alas, most banks will delay raising their savings rate so they can earn a higher profit off of their customers. The analogy is akin to a rise in oil prices. Gas stations will raise prices in lock step with a rise in oil prices, but will be much slower in lowering gas prices when oil prices fall.

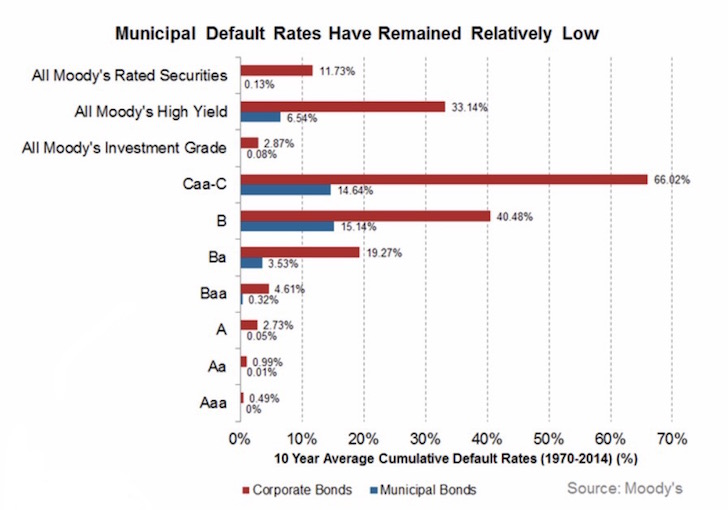

2) Highly rated municipal bonds. Despite multiple financial crises since 1970, municipal bonds rated A or higher have a 0% – 0.05% default rate. With no federal and state taxes to pay on the coupon, municipal bonds are more attractive to income earners in the highest income tax brackets.

3) US Treasury Bonds. Given the dollar is the world’s currency and the US treasury can alway print more money to pay off debt, US treasury bonds are considered risk-free. If you hold a 10-year Treasury bond for 10 years, you will get your annual coupon and full principal back. Below is the five year historical chart of the 10-year Treasury bond yield. If you buy a 10-year treasury bond today, you will get a 2.96% annual coupon.

4) Another CD. If you don’t indicate you want your CD proceeds to be deposited to another account, the bank will give you a grace period and automatically re-enroll you in the same duration CD at whatever rate they are currently offering. Beware that this is generally a poor choice as the terms are sometimes less favorable given rates have been declining since the 1980s.

When I locked in my CD at 3%, it was USAA that was offering the highest rate. They are one of my favorite companies since I’ve been using them since 1994 when I first got my driver’s license. Now, their 1 year CD rate is only 0.71%, 5 year CD rate is only 2.13%, and 7-year CD rate is only 2.17% despite rates having moved back up to where they were.

Looking at CIT Bank again, they have an interesting 11-month CD rate at 1.85% with no pre-withdrawal penalties after 7 days the money is deposited. That’s so much better than any ~1-year CD rate I’ve found. Just search the web for the best rates from reputable financial institutions.

5) A business arbitrage. Whenever you find an opportunity to spend a dollar and get more than a dollar in return, you should spend until the marginal revenue equals the marginal cost. The most common business arbitrage is hiring an employee for X and having the employee produce X+. No employee would continue to have a job if s/he didn’t produce more than they cost. Another common business arbitrage is advertising online. Due to sophisticated data analytics, it’s very easy to see what type of return you can get from an advertising campaign, especially on fake news platform, Facebook.

Related: The 10 Best Reasons To Start An Online Business

6) Yourself. Given your investments should largely be a pleasant tailwind for your path to financial freedom, the biggest investment you can make is in yourself. Your main source of income is likely from your job or business. Therefore, it behooves you to invest in yourself to become a better employee or entrepreneur.

The best investment someone can make in themselves is to learn how to be a better communicator. Once you become an expert speaker, writer, and presenter, opportunities start flooding in. Intelligence is highly overrated. Learn how to make people feel like they are the only one you are talking to. Learn how to capture the imagination of your listeners. Make people feel like there’s a deep connection so they become your or your product’s greatest advocates.

Related: Emotional Intelligence: The Key To An Easier Life

7) Pay down debt. No matter how low the interest rate, I’ve never regretted paying down debt and neither will you. For example, it feels absolutely wonderful to no longer owe the bank $815,000 after I sold my rental house last year. When I paid off my MBA loans, I felt like a weight was lifted off my young shoulders.

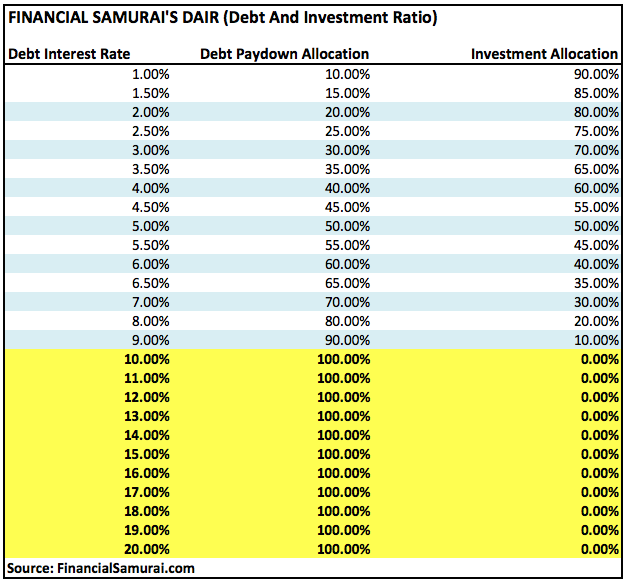

Here’s my FS-DAIR framework if you’re wondering how much of your free cash flow you should use to pay down debt and invest. Any interest rate at 10% or higher is highway robbery and should be paid down with great focus.

Stay Conservative Most Of The time

For a long time, I wondered how I’d reinvest my CDs once they started coming due. Interest rates had fallen drastically over time. Sometimes, you can afford to take more risk.

In early 2014, a $400,000 CD expired and interest rates were still low back then. Hence, I decided to take more risk by investing $250,000 of the proceeds in a fixer that was asking $1,250,000. Taking on leverage to buy a single concentrated asset is certainly not a low risk endeavor. However, I felt strongly that panoramic ocean view homes in San Francisco would rapidly rise in value. Besides, I had two other CDs in the wings, including this one that recently expired to bail me out just in case things went south.

In 2018, I no longer feel strongly about coastal city real estate or the US stock market. My risk-free / low-risk asset allocation has also fallen towards the lower end of my target 5% – 10% net worth allocation. Therefore, I plan to reinvest 50% of this CD’s proceeds in municipal bonds, 20% in an online savings account, 20% to pay down my Lake Tahoe vacation property, and 10% in the stock market if we see another 5% – 10% correction.

Although higher interest rates have created a headwind for riskier investments, those of us who need conservative investments with dependable income should be rejoicing!

Related Posts:

Ranking The Best Passive Income Streams

How Much Savings Should You Have Accumulated By Age

Readers, do you have any CDs? How are you reinvesting the proceeds?

The post Reinvestment Ideas From An Expiring CD: Stay Mostly Conservative appeared first on Financial Samurai.

No comments:

Post a Comment