Let’s say you don’t have the capacity to build a business to boost your wealth like the richest people on Earth. You can always just buy a business instead. The following post is by John, an early 50s retiree from ESI Money, a blog about achieving financial independence through earning, saving, and investing (ESI). He recently purchased Rockstar Finance, a leading curation site for the best personal finance articles.

Let’s say you don’t have the capacity to build a business to boost your wealth like the richest people on Earth. You can always just buy a business instead. The following post is by John, an early 50s retiree from ESI Money, a blog about achieving financial independence through earning, saving, and investing (ESI). He recently purchased Rockstar Finance, a leading curation site for the best personal finance articles.

One of the main questions I’ve received since I bought Rockstar Finance is simply, “Why?”

Sometimes it’s phrased as, “I thought you were retired” or something similar, but at the heart the meaning is always, “why would someone buy a business after he retired?”

Since Sam talks about owning web businesses and the various options to pursue after retirement, I thought a guest post on Financial Samurai would be the perfect place to explain my reasoning.

Background

For those of you not familiar with my history, here’s a quick summary:

- I retired in August 2016 at 52 after a 28-year career in business. I was actually financially independent in my early 40’s and should have retired then, but that’s for another post.

- I didn’t really know what to expect when I retired, but I discovered there were several positive surprises awaiting me.

- After a year a series of events conspired to allow me to buy Rockstar Finance. I decided to proceed and finished the transaction in December 2017.

Now that we’re all on the same page, let’s get to the details.

What is Retirement?

Recently I did an interview and was asked, “How do you define retirement?”

My response was as follows:

I define it as the freedom to do what you want.

Back in the day retirement was generally defined as 1) you quit work and 2) you indulged in leisure activities like golf, bowling, traveling, and so forth until you eventually died.

Today I think “retirement” is getting rebranded, especially by those of us doing it earlier than the traditional age, to mean something else. Or perhaps I’m not “retired”, I’m just “financially independent.”

Whatever you call it, I don’t work for an employer and spend all my free time on what I want — some of those things being investing and running a couple websites and some of them being more leisurely like traveling, reading, and so forth.

This is the gist of my answer for the “why?” question.

The definition of retirement is changing, even for those retiring at a more traditional age. People are living longer. And they are remaining in better health longer. So while retirees at 65 used to sit back and take it easy, these days they are having hips replaced and running marathons.

Today’s early retirees are just an exaggeration of this trend. They have even more time, energy, fitness, and so on for activities. Some of their interests are recreational and some are work-related. The only difference now is that the work is something they choose to do versus something they have to do.

Here are the mains reasons why I bought a business after retiring.

Seven Reasons I Bought A Business

Let’s dig in a bit and examine why I took the plunge:

1. I needed something enjoyable to do.

I remember my pastor used to say how he was never retiring because he’d be bored to death. He had plenty of hobbies, but felt that there’s only so much time you can spend in recreation.

I used to think he was full of it. After all, who wouldn’t want to sit around and just chill for the last 20 years of their life?

Uh, me. I wouldn’t.

Once the stress of 28 high-power work years melted off (which took about six months), I realized that I needed something enjoyable to do with my extra time. In my case “enjoyable” and “challenge” go hand-in-hand. Owing a business seemed like a perfect solution for both.

You don’t have to go far to see that I’m not the only one who thinks this way. For example, look at the author of this blog. Sam is certainly wealthy enough to retire now and do absolutely nothing.

And yet, if I’m not mistaken, he still:

- Actively manages his rental properties

- Coaches high school tennis.

- Consults with businesses now and then.

- Volunteers as a foster kid mentor.

- Publishes regularly on Financial Samurai.

- Spends at least 40 hours a week taking care of his son.

I’m probably missing one or two things but you get the idea.

You could classify at least three of the above as “work.” So I’m not the only one who has created jobs for myself after retirement. And I think as time goes on and retirement is further redefined by a younger set of people we’ll see that some sort of job, business, or side hustle will increasingly become part of the equation.

Also consider the traits that it takes to become financially independent at a younger age and you’ll notice that many of them are also qualities often required for business success. In that light a post-retirement business or money-making hobby seems very natural.

If retirement is truly about “the freedom to do what you want” and business is enjoyable to you, why would you NOT want to own a business after retirement?

2. I needed something to keep me sharp.

You’ve heard the phrase “use it or lose it”, right?

Well, that’s what appears to happen with your mind. And retirement can be especially hard on the brain.

A major British study which tracked 3,400 retired civil servants found that short-term memory declines nearly 40 per cent faster once employees become pensioners. It appears that the lack of regular stimulation takes a heavy toll on cognitive function and speeds up memory loss and dementia, researchers warned.

Yikes! This is scary stuff! It turns out that I not only wanted a mental challenge but I need one too.

Yes, you can keep you mind active from other sources. This is why I also read more than ever, write a ton of articles, listen to podcasts, and do my daily chess puzzles. They all help, for sure. But there’s something unique about running a business that challenges the mind in an awesome and beneficial way.

Sure, my own blog could fill some of this need for me, but it wasn’t enough on its own — I needed a more complex business to challenge me mentally. Turns out that Rockstar Finance was just the right fit.

3. I was looking for a great way to invest some cash.

Because I generate more than enough income from my website and rental properties to cover our living expenses (with zero drawdown of assets), I was starting to accumulate quite a bit of cash during retirement.

I had thought about re-deploying some money into buying more real estate, but the two markets I was considering (my current city and the one where my properties are located) are too, too hot for my taste. Prices are simply CRAZY!

My cash kept piling up in a “high yield account” (an oxymoron if there ever was one) earning a whopping 1%. It was killing me to watch it sit there. I had a load of money earning virtually nothing.

So I decided to take money that was yielding 1% a year and turn it potentially much more. Assuming the asset itself wasn’t going to lose value, it seemed like a no-brainer. Even if the value of the site went to $0 it would not impact my lifestyle one bit. So why not?

Generally sites are valued at two times annual profit. If a site earns $50k a year it’s value is somewhere in the $100k range.

I ended up paying five to six times earnings and I still felt I was getting a good deal. The reason is that I estimated what I thought the site could make each year, discounted it a bit, and then paid roughly two-times THAT annual profit. In addition, I knew I could use Rockstar to drive traffic to my own site. My best guess is that ESI Money will earn an extra $10k this year simply because of both the traffic and relationships that Rockstar has. This is all gravy and was not part of my estimations.

It seemed like a great way to take low-performing dollars and transform them into high-performing dollars. Five months later, it appears this estimate was correct.

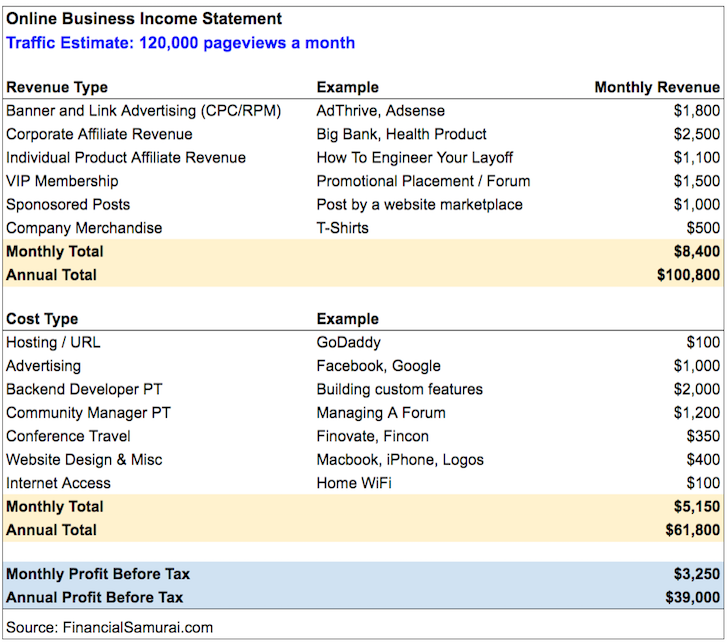

Sam’s note: below is an income statement I put together guesstimating what a site like Rockstar Finance could or is making. If ESI Money bought the business for $100,000, he would make back his entire capital in just 2.6 years, assuming no revenue or profit growth. After 2.6 years, he would earn a 39% annual return for his efforts.

Related: Real Estate vs. Blogging For Maximum Returns

4. I wanted to help personal finance bloggers.

Most people outside the personal finance blogging community don’t know this, but I began blogging in 2005. Yes, 2005. It was a looooong time ago.

Eventually it was discovered I ran that blog by people at work. I was the president of a company at the time. To say it was a bit awkward to have my money life open to all 800 employees is a bit of an understatement.

I still have that site but now simply post basic money stuff there. A few years after being outted I re-started my blogging escapades with ESI Money.

As a result of being around so long, I have made a lot of blogging friends and I love the personal finance blogging community. In particular I like helping new, motivated bloggers achieve their dreams and become better faster. Rockstar Finance gave me a platform to help others like never before. It’s very rewarding.

One service we created at Rockstar was a VIB (very important blogger) program where site owners sign up (for a fee) and receive various benefits relating to site traffic and revenue generation. The program just started on March 1, but we have already seen some tremendous results. The future is very promising and I’m thrilled to be part of helping bloggers reach their goals.

At some point in your life simply giving back to others is the reward in and of itself. Owning Rockstar is a way I can do this on a much bigger scale.

The first blogger I helped out by purchasing Rockstar Finance was J Money from Budgets are Sexy. He is the founder of Rockstar who sold to me. He wanted to free up some time since he and his wife were about to have their third child. I was excited that this extra benefit was part of the sale — that I could pass along funds to a good man, help expand his legacy, and be part of his plan to achieve one of his life goals.

5. I wanted something I could pass along to my kids.

As I was considering buying Rockstar, one thing that kept going through my mind was that this site was something my kids could run one day.

My daughter is a very good writer and my son has some amazing creative skills, so both of them already have traits that would help them.

Now whether or not they want to take it over is another thing (they will need to learn quite a bit about money in the meantime), but at least this gives them something to think about.

There are many advantages to a web-based business and if one of my kids decided to rise to the challenge, they could own a site that can be run anywhere in the world, would pay them more than they will likely earn in their jobs, and would only require a handful of work hours each day.

They could literally “retire” (at least from working for the man) at a very young age.

Sounds great, right?

Related: How To Stop Worrying About Your Child’s Future In This Brutally Competitive World

6. I wanted something that wasn’t too much.

Piggy backing on the above comments a bit, Rockstar Finance is a perfect retirement business for me because:

- It only requires 3-4 hours each day. Yes, I have help (Steve from Think Save Retire runs the operational side of the site) but the revenue supports that. My commitment is a few hours a day on average — just enough to be enjoyable but not too taxing.

- The hours are flexible. I can work 7 am to 11 am, noon to 4 pm, 9 pm to 1 am, or any combination of hours I like in a day. I often work more on some days and hardly any on others (we went to Grand Cayman for nine days in January and I worked on the site maybe an hour during that time.) BTW, Steve was in Mexico at the same time, so we were pretty much on auto-pilot. But we had done the work in advance, so it all ran like clockwork.

- The business is location independent. If I had wanted to, I could have done everything site-related in Grand Cayman that I do at home. The internet was great down there and I had my laptop, so I was good to go. Don’t tell anyone, but I may just test it out next year — my nine days could turn to three weeks if it all works out. Or if Sam would just buy that place in Hawaii, I could stay for free, and that would be even better! :)

When people hear that I bought a business in retirement I think much of their angst is because they assume I spend 40-50 hours per week in an office somewhere chained to a desk. No, it’s nothing like that. If it was, I would not have bought it.

7. I wanted to give more.

I’ve talked about the balance between doing all you can to retire early versus slowing down that progress by giving along the way.

It’s an issue that everyone needs to sort out for themselves, of course, but we decided to simultaneously give and save. In fact, we gave away 26% of our gross income while saving for early retirement. The world is a tough place for so many. We feel blessed to be where we are and want to help as many in need as possible as soon as possible.

I’d like to ramp up our giving in retirement and Rockstar gives me a great opportunity to do so. In fact, Rockstar has always had a large charity component as part of the site, and I want to lean into that heritage. This Christmas season we’ll turn it up a notch or two in this area, so stay tuned.

Buying A Business Can Be The Perfect Solution

In the end, retirement is about freedom of time and doing what you choose to do. Buying a business fit the bill for me. I hope you find the same in retirement.

Along those lines, what do you think you’ll enjoy doing when you retire? Or what do you enjoy doing now if you are already retired? If you’ve ever bought a business, I’d love to hear how that went.

– John, ESI Money

The post Why I Bought A Business After Retiring: The Rockstar Finance Acquisition appeared first on Financial Samurai.

No comments:

Post a Comment