Now that I’m a 40-year-old father, I’ve been reflecting on whether the financial goals I set in my 20s were necessary in order to have children. I have a couple of friends whose families were ruined because they were always under monetary stress.

Now that I’m a 40-year-old father, I’ve been reflecting on whether the financial goals I set in my 20s were necessary in order to have children. I have a couple of friends whose families were ruined because they were always under monetary stress.

We all know that children are expensive. The budget route for each child is ~$250,000 for 18 years. The expensive coastal city route is closer to $1,000,000. If your kid goes to college for four years, add on another $100,000 – $400,000. Further, if your kid expects you to pay for their BMW and starter home as an adult, you’ve got to add yet another $200,000 – $2,000,000!

Here were my goals before having children:

- Have a $1 million net worth

- Own a three bedroom, two bathroom house in a safe neighborhood

- Be in a stable career by age 30 or at least be on the right track

I clearly remember having these goals because a buddy at my first job told me about his $1 million net worth goal before having kids. He was an old 24-year-old first-year analyst at Goldman Sachs because his parents had held him back one year. He’d gone to an expensive prep school and then attended Yale.

To him, he needed at least $1 million before feeling ready to be a dad because he wanted his kids to go the same educational route as he – prep school, private university. As for me, I didn’t know what I wanted. All I knew at the time was that I had a chance to make a good amount of money through my career if I survived.

As an impressionable young man who lived in Manhattan, a net worth goal of $1 million sounded good to me, so I went with it.

Too Aggressive A Goal

Because I had a $1 million net worth goal, I logically focused on my career, saving, and investing. There was no time for family. I don’t remember ever once thinking in my 20s that I wish I had a kid. All I thought about was how big my year-end bonus was going to be and whether or not I was on track to get promoted to Associate, Vice President, Director, and finally to Managing Director. I never got to MD because I left as a third-year Director at age 34.

Now that I’m a father, I think how crazy it would be not to have had my son. I wish I hadn’t focused so hard on my career so I could have had him sooner – ideally three years earlier. Given your kid will be one of the people you love most in your life, you will naturally wish you had him or her for a greater percentage of your life.

My net worth goal was one reason why I delayed getting married until I was 31, even though I knew my wife since I was 22. Before 31, I didn’t feel financially stable enough to support a family which had a child and a non-working spouse. There’s no way I wanted to go into a marriage without a strong feeling of financial security.

You have to remember that at the age of 28, I had assumed a massive $1,300,000 mortgage because that’s what it took to finally buy a three bedroom, two and a half bath house in San Francisco back in 2005 (goal #2). As a second-year VP, I had also taken on a lot more client responsibility, which meant a lot more stress to perform. Then, of course, the financial crisis hit me like a tsunami.

But it’s funny because we got married right in the middle of the financial crisis. I figured I had waited long enough, and losing lots of wealth made me want to hold onto the very person who was there since the beginning. The memory that sticks the most from the financial crisis is our 16-person wedding party on our favorite Oahu beach.

Have A Reasonable Net Worth Goal

Looking back, having a $1 million net worth goal before having children was unnecessary. My parents raised my sister and me just fine without being millionaires. Why the hell did I ever think I needed $1 million to be a competent father?

Answer: Peer pressure. Be careful about letting other people’s lifestyles influence your own, including mine!

That said, I do believe having your financial house in order is important before having children because raising a child is truly one of the hardest things you’ll ever do. You’ll be constantly tired, worried, and stressed. You’ll lose your “me time,” and some romance.

Plenty of couples divorce after having kids, even though they know happily staying together is best for the people they love the most. Think about that folks. They couldn’t work out their differences for the sake of their children.

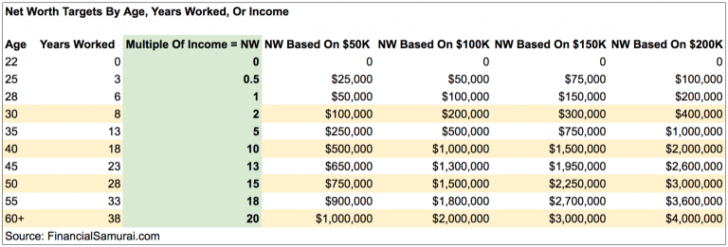

Given I believe the ideal age to have children based on biological and economic reasons is in your early 30s (32 to be exact), let’s look at my handy-dandy net worth target by age chart to see what a more practical net worth target should be before having children.

In other words, a suggested net worth of between 2-3X your gross income before having a baby today sounds about right. If you want to have kids sooner and can accumulate 2-3X your gross income at a younger age, then wonderful.

If two of you make $50,000 a year and live in San Antonio, having a combined net worth of between $200,000 – $300,000 will give you some breathing room in case one parent wants to take a three to five year break to care for the child before pre-school or kidnergarten. The median-priced home in San Antonio, Texas is $205,000.

If two of you make $150,000 a year and live in San Francisco, having a $600,000 – $900,000 combined net worth in your early 30s will allow you to consider paying $20,000 a year for elementary school in case your child doesn’t get placed at your local public school due to the lottery system for social engineering for the greater good of all mankind. The median-priced home in San Francisco, California is $1,500,000.

If you’re a single parent making $250,000 a year and live in Manhattan, having a $500,000 – $750,000 net worth might be necessary because you will need to hire a lot of help. That, or your parents can move close by to provide free support. The median-priced condo in Manhattan is $1,300,000.

Want more than one child? Then continue to follow the gross income multiples in the chart. The minimum it takes to have another child is usually at least one year.

Stability Is Key

Having a child helps crystallize the value of homeownership even more. When you have a child in school, you don’t want to be at the mercy of a mercurial landlord. Imagine how traumatic it might be for your child to be removed from a safe and familiar environment.

Having money and a house is all about stability. The more stable your environment, the less likelihood for conflict and divorce. Money will always be one of the top stressors in a relationship. But an overall lack of stability will inevitably torpedo even the strongest bond.

You most certainly can rent and have a lower net worth before having children as many people do. I’m just trying to provide a financial guideline to help give couples who want children a better chance to survive the chaos.

Providing for a family and being a present parent is already hard enough. Let’s not add excessive money worries into the equation.

Related:

The Average Net Worth For The Above Average Married Couple

Divorce After Kids: Try Bird Nesting For Stability

A Day In The Life Of Two Stay At Home Spouses Who Also Work

Readers, do you or did you have any net worth goals and other goals before having children? What do you think about having 2-3X your annual gross income as your net worth before having children? Do you think if more couples had their down there would be less divorce?

The post Net Worth Goal Before Having Children: How About $1 Million appeared first on Financial Samurai.

No comments:

Post a Comment