I’d like to think that I’d be able to stay the course and go all-in during a stock market downturn like everybody I meet on the internet, but I’d be lying to myself.

I’d like to think that I’d be able to stay the course and go all-in during a stock market downturn like everybody I meet on the internet, but I’d be lying to myself.

Experiencing rapid losses in 2000 as a 23-year-old freaked me out. Therefore, I sold all my after-tax internet and tech stocks within two months after the downturn began because I was losing roughly $5,000 a week. In the end, I lost about 10% from the peak. If I hadn’t sold, I would have lost around 65% over a two year time period. What’s worse, I would have had to wait until Aug 1, 2013 to get back to even! Can you imagine sitting on dead money for 13 years?

Between 2000 – 2013 I continued to max out my 401(k) and buy stocks. But I didn’t have the foresight to go all-in on August 1, 2002 when the NASDAQ bottomed. Instead, I mostly hoarded cash and bought 4.5% yielding CDs as I moved from NYC to San Francisco in 2001. The last people to join a company tend to be let go.

Seeing how violently stocks corrected between 2000 – 2002 made me gun shy to ever bet the farm again. Instead, I bought San Francisco property in 2003, 2005, 2007 (Tahoe, oops), and 2014 because it felt so much better to have a physical asset instead of a paper asset.

After the financial crisis of 2008 – 2009, I again didn’t step up to the plate and buy large amounts of stock or property between 2009 – 2011. All I did was continue to max out my 401(k) and make sure I didn’t get laid off. I became disillusioned with the financial services industry and wanted out. Therefore, I ended up hoarding more cash to give me options just in case I decided to take a leap of faith, which I did.

It wasn’t until August, 2012 that I bought 12X more stock than my normal cadence due to a severance windfall. I viewed my severance as the house’s money, so I figured why not risk it all and see if I could make more in the future. With my non-severance cash flow, I remained conservative.

Despite feeling like we were out of the woods by 2014, I still couldn’t invest aggressively in the stock market. I was again fearful of losing money. Instead, I decided to buy a SF fixer in 2014 because it felt like there was some serious mispricing of SF ocean view property. But the other reason why I bought was because I wanted to reduce my housing expense by renting out my old place.

Still Concerned Today

After selling a SF rental home in the summer of 2017 in order to simplify life, I decided to invest ~$1.2M of the ~$1.8M net proceeds in stocks and bonds. I had already taken risk exposure down by $800,000 by getting rid of the mortgage.

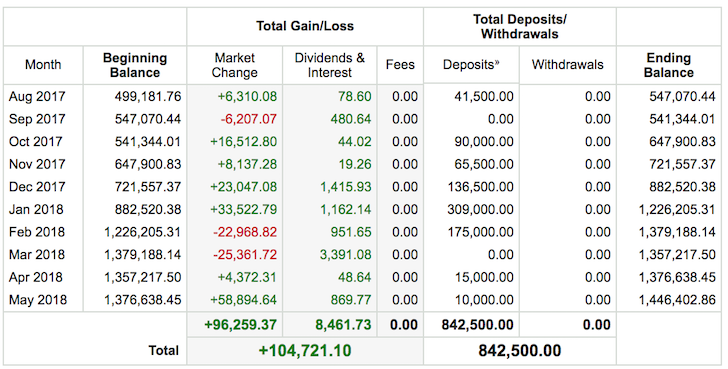

Everything had been going pretty well since August 2017 when I first opened up the account. Then February and March 2018 beat me up.

Even though I “only” lost $22,968.82 in February and $25,361.72 in March, there was a time in February where I was down around $50,000. February was a month that had a violent drop and then recovery. But March ended the month at a low. See the chart below.

Losing $50,000 in a couple weeks in just one out of eight investment accounts I track on Personal Capital made me seriously reassess my risk tolerance. When I was down $50,000, I became demotivated to do any work. For example, being offered $1,000 to sponsor a podcast episode just made me depressed because it let me know I’d have to put in serious hours to recoup all my losses.

I also wanted to start spending money on something before the stock market took all my capital away.

Overall, my mood soured as I cursed myself for taking on excess risk I didn’t need. Things had been going so great in December 2017 and January 2018. I should have sold in January when the market started going parabolic, but I didn’t because I was greedy. I also started to regret selling my former home, despite all the maintenance and tenant headaches.

The only positive this year is that I invested another $175,000 in the market in February to take advantage of the sell-off. But I invested $0 in March because I was too scared of what the future might hold.

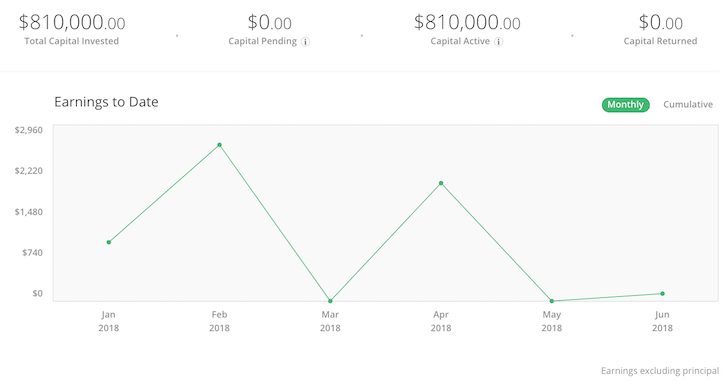

Then I looked over to my RealtyShares account where I had invested $550,000 of my house sale proceeds. Ah, no change in principle with modest earnings to date. It felt so nice in comparison, even though the real figure to focus on is the Capital Returned portion of my 14 equity investments. But that will have to wait for several more years.

What I realized after reviewing my RealtyShares dashboard is that I really don’t like volatility. It’s nice to see my stock and bond account go up, but the feeling of loss is at least 2X worse than the feeling of joy when I make money. Instead, I’d much rather have a very stable capital account with a monthly dividend payment so I can focus on writing and spending time with family.

Here’s hoping my real estate crowdfunded investments do indeed return 10% – 15% a year for five years.

Don’t Overestimate Your Risk Tolerance

Look, I know it’s easy to feel like an investing guru in a bull market. Especially if you only started investing a significant amount of capital since the financial crisis. But trust me when I tell you that your confidence to “stay the course” and “buy when there’s blood on the streets” is misguided.

When there is blood on the streets, you will be worried about losing your job or your customers. If you have leverage due to a mortgage, your equity will get zapped away. You will logically go into survival mode and start preserving capital to protect yourself from misfortune.

During a recession, maxing out your 401(k) or IRA, pre-tax retirement accounts you can’t touch without a penalty until 59.5 is easy. This is where everybody needs to stay the course. It’s taking a step beyond and risking significant amounts of capital in your after-tax investment accounts when the markets are going down every day that is extremely hard.

Maybe everything is relative, and those telling me to “stay the course” are simply maxing out their 401(k)’s to the tune of $18,500 a year and not referring to investing multiple times extra in after-tax investment accounts. No matter. Right now, I fear having to go back to work full-time to provide for my family more than anything else.

Evaluating Your Risk Tolerance

Here are some questions you should ask yourself to discover your risk tolerance.

* What percentage of your annual salary or annual expenses are you willing to lose before you start getting extremely uncomfortable? My answer: six months worth of expenses.

* How much longer are you willing to work to make up for any large losses? My answer: three months.

* How much time are you willing to spend away from your family? My answer: no more than three days a year for the first five years.

* Have you been laid off before? If so, chances are higher than average you will be laid off again during the next recession. My answer: yes, but on my terms with a severance.

* How much in after-tax capital did you put to work during the 2000 and 2008 financial meltdowns? My answer: not much at all besides maxing out my 401(k).

* Did your losses in 2008-2009 equate to more than a year’s salary? My answer: yes, many years worth.

* If you lose your job and 40% of your investable assets, do you have enough liquidity and alternative income streams to hold you over for at least a year? My answer: yes, although my alternative income streams will likely decline.

* Does your mood tend to follow the market’s ups and downs? My answer: there is a stronger correlation on the downside.

* Do you confuse brains with a bull market? My answer: all the time.

Whatever you think your risk tolerance is, take it down by 50% and that is more likely your real risk tolerance. Being overly confident is extremely dangerous when it comes to investing.

Related:

Why Stocks May Be A Better Investment For Some Investors

Recommended Net Worth Allocation By Age Or Work Experience

Readers, do you think younger investors are underestimating their risk tolerance? How can we get people to realize they aren’t as risk tolerant as they believe? Are you an internet investing genius?

The post Risk Tolerance Is Difficult To Accurately Measure Until You Start Losing Big Money appeared first on Financial Samurai.

No comments:

Post a Comment