When you’re young, you spend time accumulating wealth. When you’re old, you should spend time protecting wealth.

Multi-millionaires go broke all the time because they exposed themselves to too much risk and temptation. Think about all those pro athletes who would still be rich if they had just kept all their money in a bank.

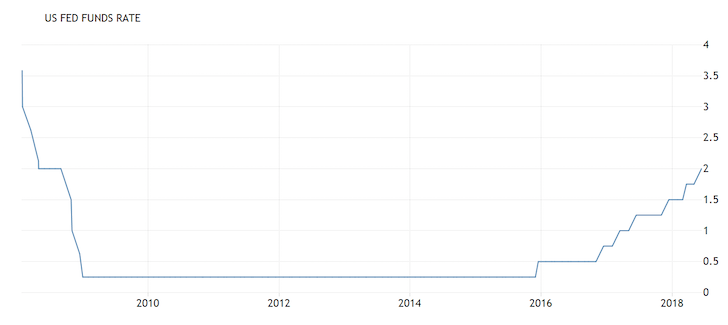

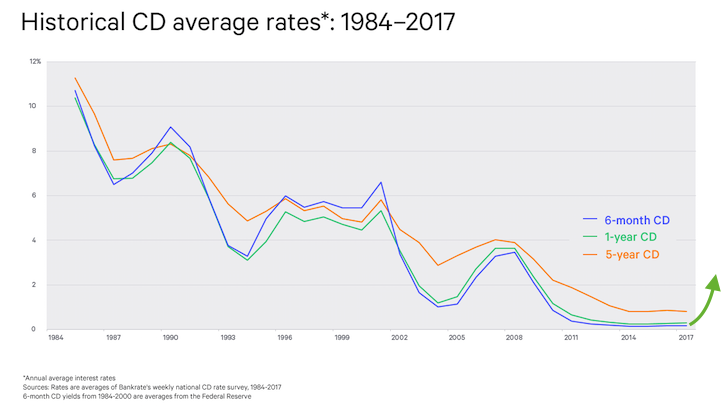

Since 2010, money market and CD rates have been particularly horrible. Retirees depending on fixed income were forced to take more risk. And thankfully, such risk has paid off as the S&P 500 and the real estate market across various parts of the country took off. Further, we’ve all been able to refinance our mortgages at rock bottom rates.

The Fed Funds rate is the overnight inter-bank lending rate

But now, rates are finally moving up given the Federal Reserve has raised their Fed Funds rate multiple times since 2015. No longer do you have to lock in a CD for five years to get only a 2% rate. No longer are you only getting 0.1% on your money market account either. Remember those dog days? You can now get a 12-month CD paying 2.5% or a money market account that pays 1.85%.

With a 12-month CD rate paying 2.5%, you’d think that you could get a much higher rate if you decide to lock up your money for longer. Unfortunately, the best rate for a 5-year CD is currently about 3% in 2018, hardly high enough to lose four more years of liquidity.

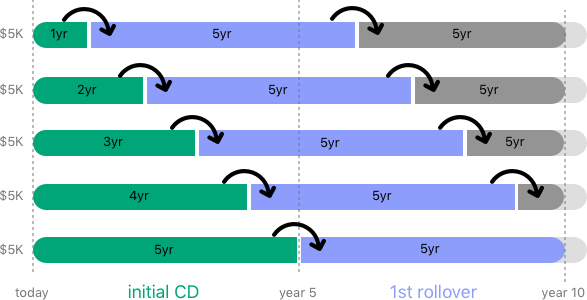

As a result of a flattening yield curve, financially savvy individuals should optimize their cash and build a CD Step Stool and NOT a CD ladder. The first step is a one-year CD and the second step is a two-year CD at most. With each expiration of the CD, the strategy is to re-invest the proceeds in another 12 – 24 month CD. Only if the yield curve steepens should you consider building a CD ladder where you’re investing in three, four, five, seven, and 10 year CDs.

Let’s look at various financial scenarios where building a CD Step Stool may or may not make sense.

Building A CD Step Stool

If you are up over 150% on the S&P 500 since 2010 and your real estate equity is up even more due to leverage, your net worth has likely way more than doubled since 2010 when you add savings to the mix. Therefore, at some point, you should start thinking about taking risk off the table when risk-free returns are rising.

With A CD Step Stool, you get the best bang for your CD buck, while never putting yourself in real danger of a liquidity crunch since you’re never more than 12 months away from accessing your cash. Further, you can always utilize the monthly CD interest payment or break your short-term CD if things get really bad by giving up usually half the CD duration’s worth of interest.

Example #1: Financially Independent Couple In Their 60s

Liquid Net Worth In 2010: $3,000,000

Liquid Net Worth In 2018: $10,000,000

Household Gross Income: $50,000 from part-time consulting and social security

Household Expense: $200,000

Potential Risk-Free Gross Income: $250,000 based off a 2.5% on their $10,000,000

Total Household Gross Income: $300,000

Total Household Net Income (25% effective tax rate): $225,000

Why would this 60-year old couple risk the majority of their liquid net worth in risk assets that could easily result in a capital loss? Instead, they would probably best be served to invest 90% of their liquid net worth in a risk-free CD yielding 2.5% and speculate on the remaining 10%.

The remaining 10% is still $1,000,000, which could conceivably earn or lose them hundreds of thousands of dollars a year. But even if they lose 100% of this $1,000,000, they’d still be earning $225,000 a year in risk-free gross income to support their lifestyle.

They could either invest a lump sum into a 12-month CD today at 2.5%, or they could create a CD Step Stool since the Fed has telegraphed they will raise rates further. Given money market rates are pretty attractive again, it’s probably a good idea to do a combination of both a short-term CD and a money market account.

Point: There is no need to take excessive risk after a tripling of net worth to $10 million. Since they have already won the lottery, it’s good to stop gambling and start enjoying life to the maximum.

Example #2: On The Path To Financial Independence, Couple In Their 40s

Liquid Net Worth In 2010: $500,000

Liquid Net Worth In 2018: $2,000,000

Household Gross Income: $180,000

Household Expense: $100,000

Potential Risk-Free Gross Income: $50,000 based of 2.5% of $2,000,000

Total Household Gross Income: $230,000

Total Household Net Income (20% effective tax rate): $184,000

Thanks to aggressive saving, pay raises, rental real estate appreciation, and great stock performance, this couple was able to 4X their liquid net worth in nine years. They could conceivably dump their entire $2,000,000 liquid net worth into a 2.5% yielding 12-month CD to earn $50,000. However, that would leave a ~$60,000 expense hole after paying a 20% tax rate on the CD income.

But what is important to realize is that this couple has now closed the income gap they need to achieve true financial freedom – when passive income covers all expenses. In order for the couple to achieve financial freedom, the interest rate on their risk-free income needs to be closer to 6.2% so they can earn $125,000 in gross income to pay for their $100,000 lifestyle using a 20% effective tax rate.

Alternatively, they need to accumulate closer to a $5,000,000 in liquid net worth, which may be harder to do over the next nine years than it was the previous nine years. Good thing interest rates are expected to go a little higher, and $5,000,000 is probably unnecessary.

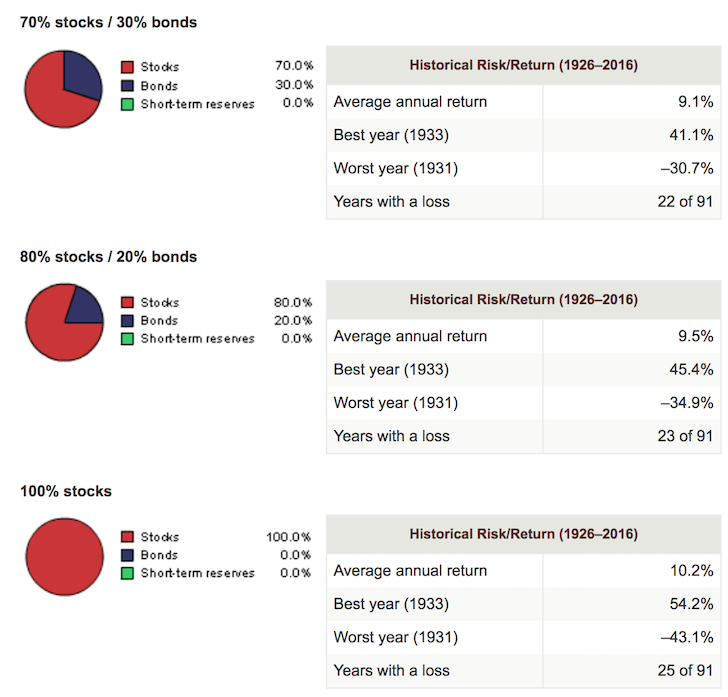

The solution is to keep on working in order to make their $180,000 gross annual income and take more risk, but not a whole lot of risk. We know that since 1926, a portfolio of 20% stocks / 80% bonds has provided a 6.6% annual rate of return. But given we are in a rising interest rate environment, it’s unlikely that bonds will perform as well as they have. Therefore, the solution is to supplement some of the 80% of bond exposure with risk-free CD income exposure through a CD Step Stool.

The couple can see the finish line and don’t want to mess things up. With 40% of their household expenses covered ($40,000) through a risk-free short-term CD after-tax, this couple now has more flexibility in their lifestyles. For example, one spouse now has the option to negotiate a severance to take care of their child full-time now instead of spending $25,000 on daycare. Or, one spouse can decide to start a business.

Point: On the road to financial freedom, identify which expenses your risk-free income can cover to make your life better. If you do so, you will be more motivated to build an ever-increasing passive income portfolio.

With a flattening yield curve, AVOID longer duration CDs with this classic CD ladder example

Example #3: Far From Financial Independence, 31-year-old Couple

Liquid Net Worth In 2010: $5,000

Liquid Net Worth In 2019: $300,000

Household Gross Income: $70,000

Household Expense: $50,000

Potential Risk-Free Gross Income: $7,500 based on 2.5% of $300,000

Total Household Gross Income: $77,500

Total Household Net Income (15% effective tax rate): $65,875

Despite a 60X increase in liquid net worth since 2010, this 31-year old couple is still not close to financial independence because their liquid net worth can generate only $7,500 a year in risk-free income with a 2.5% yielding CD.

As a result, the only solutions for this couple are to: 1) make more money, 2) reduce expenses, or 3) take on more risk. Based on history, a 70% equity allocation or higher provides for a 9.1% annual return or higher since 1926. But of course, history cannot predict the future.

With a $300,000 liquid net worth and decades of work energy left in this couple, building a CD Step Stool doesn’t make much sense. Instead, they should keep roughly six months of household expenses in a high-yielding money market account. But for the remaining $275,000 in liquid net worth, I have no problem with them investing 70% or more of their portfolio in equities. They’ve got time, energy, and the income to recover any losses.

Here’s a risk tolerance barometer to consider. If your annual household net income is not greater than your potential portfolio loss in any given year, you are probably too aggressive in your risk exposure. For this couple, their portfolio loss limit is therefore around 24%.

Point: Without a substantial liquid net worth, investing in risk-free assets beyond your emergency fund doesn’t make sense. Take on more risk and focus on increasing your earnings and your savings.

Time To Optimize Your Cash

CD Step Stool, Not CD Ladder

Regardless of your financial situation, everybody should take steps right now to optimize their cash balance in either short-term CDs or short-term treasuries. Short-term treasuries will pay a lower yield for the same duration, but you won’t have to pay state income tax. Therefore, if you are a high-income earner and/or have high state income tax, a short-term treasury bond may have a higher net yield.

It was OK to let your cash sit idle earning 0.1% from 2010 – 2016, but not now. Now is the time to build a 12-month CD or bond step stool in six-month increments because a 12-month CD or 12-month bond is now competitive with inflation. It’s up to you to decide how much liquid cash you feel comfortable having that can be kept in a high yielding money market account. I personally keep between 2% – 5% of my net worth in cash.

If the yield curve inverts, you should shift a greater percentage of your investable assets into risk-free investments. At this juncture, your goal is to aggressively protect your wealth. Earning 2.5% – 3% guaranteed when the stock market goes down 20% feels just as good if not better than earning 23% when everybody else is only up 3%.

Your ultimate goal is to accumulate enough wealth to live off your risk-free income and never touch principal. For example, if you can invest only 40% of your investable assets in risk-free investments and live off that income, more power to you. You’re free to take all the risk you want with the remaining 60%.

Alternatively, you can look to accumulate wealth up to the estate tax limit and invest 100% of it in risk-free investments. Given the estate tax limit currently is $11 million per person, we’re talking about earning $275,000 in risk-free gross income at today’s rates. I’m sure most people can live comfortably off $275,000 a year without any debt. Further, there’s no point accumulating more if the government is just going to take 40% away from you when you die.

Yes, our economy will come to a grinding halt when enough people stop investing and start aggressively saving. But oh well. We’re already ahead of the game at Financial Samurai. Here’s to higher rates and risk-free living in the future!

Related:

How To Make Money In The Next Recession

Ranking The Best Passive Income Investments

Readers, have you started building a CD Step Stool to take advantage of higher rates with your cash balance? How about a short-term Bond Step Stool?

To reiterate, the difference between a step stool strategy and a ladder strategy is that a step stool strategy only buys short-term CDs (12 months to 24- months max) upon each rollover since longer term rates don’t pay enough. Please share if you have seen a higher rate than 2.5% on a 12-month CD.

The post Build A CD Step Stool Not A CD Ladder In A Flattening Yield Curve Environment appeared first on Financial Samurai.

No comments:

Post a Comment