We know that a $300,000/year household income is pretty middle class if you live in an expensive coastal city like San Francisco or Washington DC.

We know that a $300,000/year household income is pretty middle class if you live in an expensive coastal city like San Francisco or Washington DC.

However, we can all agree that earning $1,000,000 a year or more makes you rich, especially since a top 1% income level starts at roughly $450,000. No household earning $1,000,000 or more should ever struggle unless they leveraged up and their investments imploded.

If you make $1,000,000 a year or more, you’re free to celebrate. Just don’t tell anyone lest you want an ax-wielding robber waiting for you in your living room after an evening of fine dining.

In this post, I’d like to explore the lifestyle of a typical $1 million income-earning household living in New York City. They’ve anonymously shared with me their expenses, and I’ve done my best to tell their story without sharing their exact details.

This post will give you a taste of what it’s like to make $1 million a year. You’ll also get to decide whether making $1,000,000 or more is truly worth the price.

Very Profitable To Make $1 Million A Year Now

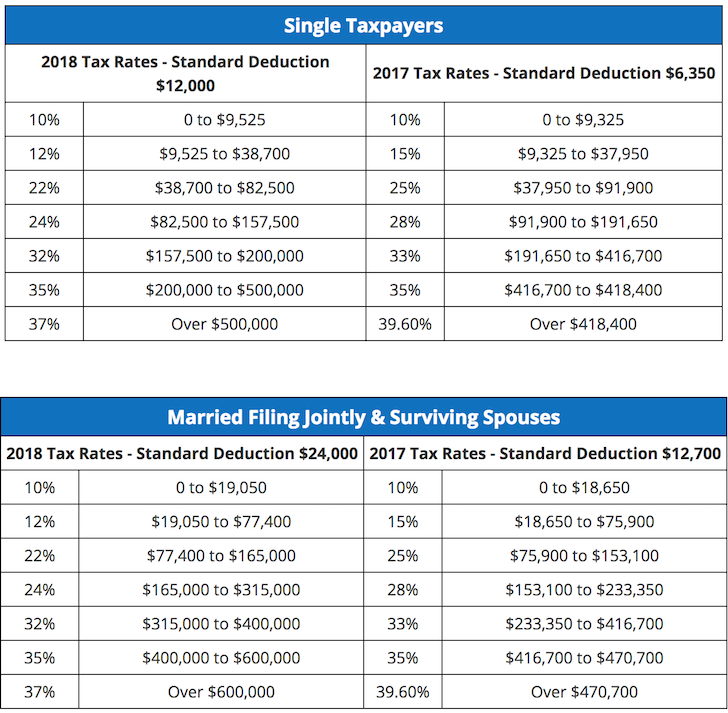

After tax cuts were introduced in 2018, making more money has never been more profitable. Not only did the top federal marginal tax rate get cut from 39.6% down to 37%, the income threshold for the top federal marginal tax rate also rose from $418,400 to $500,000 for singles and from $470,700 to $600,000 for married couples.

So, if you’ve been wanting to make over $500,00 a year as an individual or $600,000 a year as a married couple, now is the time to do it. You’re essentially getting about a $15,000 federal income tax break if you make $1,000,000 now versus in 2017.

But as we are all well aware, the desire for money and prestige tends to corrode lives after a certain point. Once you make over $200,000 as an individual or $350,000 as a family, there is no additional happiness that accrues from making more money. Instead, lifestyle tends to deteriorate due to longer hours at the office, more stress, poorer physical health, and less family time.

Rachel Chen is one such person who doesn’t know whether the $1 million lifestyle is worth it. At 45, Rachel is one of several portfolio managers at a small hedge fund with $1.5 billion in assets under management. She toiled as a research analyst on the sell-side for six years before making the leap to buy-side analyst at 28. At 37, she was finally promoted to portfolio manager.

Rachel’s husband, Colin, 41, has been a stay at home dad since their second son was born in 2011. Colin used to make about $350,000 as a strategy consultant, but got tired of all the travel and decided to give up the grind, especially after Rachel started making more. Colin has been working on a non-fiction book to keep intellectually stimulated. But it’s hard to stay focused with the kids and his wife’s robust earnings.

Income Statement Of A $1 Million A Year Household

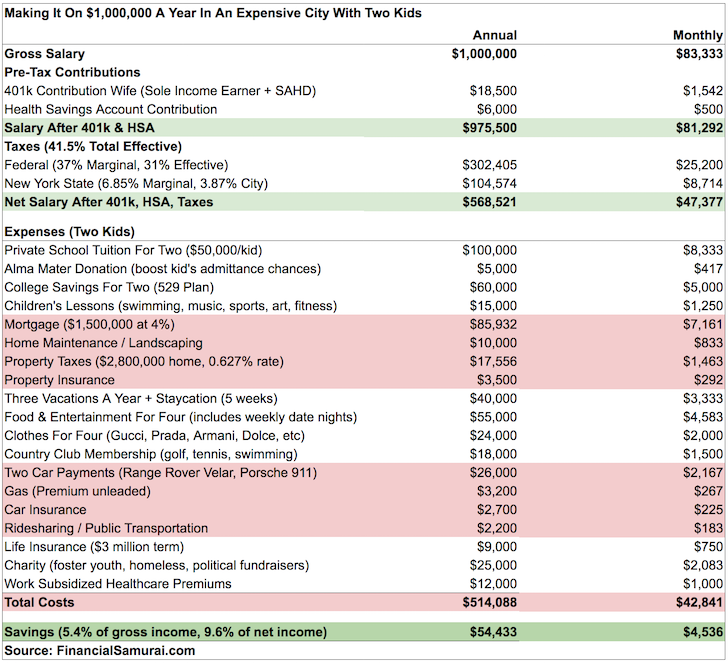

Let’s take a look at the Chen’s income statement.

Income And Tax Analysis

After maxing out her 401(k) and contributing $6,000 a year to her Health Savings Account, Rachel has a taxable income of $975,500. Her income is in the 37% federal marginal income tax bracket, and she pays an effective federal tax rate of 31%, or $302,405.

Given this household lives in New York City, they pay a State tax rate of 6.85% ($323,200+), and city tax rate of 3.87% ($500,000+). Their effective State and City tax is therefore around 10.71%, or $104,574.

Their total Federal + State + City tax bill a year equals $406,979.

As a W2 wage earner, there’s really no way around this enormous annual tax bill. Due to the SALT (State And Local Tax) limit of $10,000, high-income earners in high income tax states such as California, New York, New Jersey, Connecticut, Oregon, Minnesota, and Iowa lose out. Before 2018, the deduction was unlimited, but subject to Alternative Minimum Tax.

Even though the marriage penalty tax has been abolished for individuals earning up to $300,000 a year who decide to get married, the SALT cap limit of $10,000 is a marriage penalty tax. If you have two unmarried taxpayers both paying $10,000 in SALT, they will get an aggregate $20,000 when they file, whereas if they get married they suddenly lose $10,000 in deductions.

EXPENSE OVERVIEW

Private School Tuition – $100,000/Year

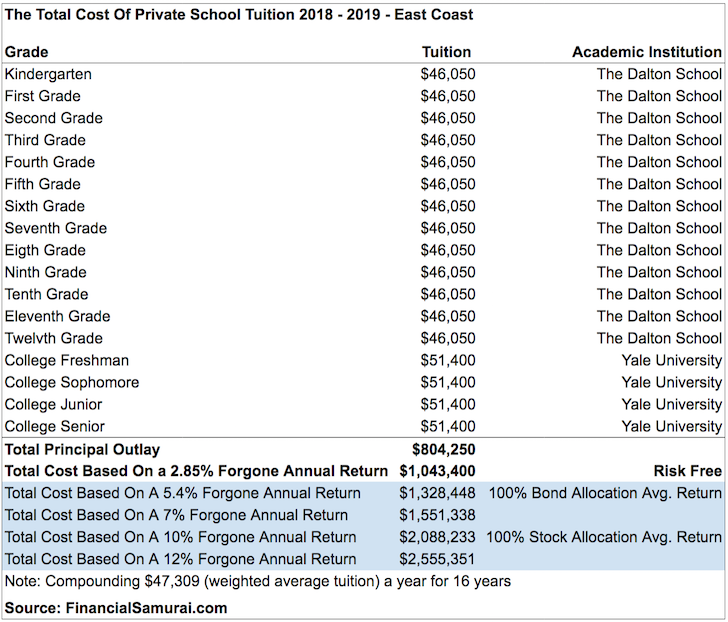

The couple forks out a hefty $100,000 a year for their two sons to attend The Dalton School. Tuition for the 2018 – 2019 school year is $48,450 a student, which includes books, computers/tablets, and lunch. Add a mere $1,550 for fundraisers and miscellaneous stuff and you’re at $50,000 per child.

Given mom and dad went to Yale University, they’d like their children to also go to Yale University. They know that Yale and all the prestigious private schools have a legacy system which gives children of alumni a huge leg up in admittance, no matter their racial or economic background. Some call this affirmative action for rich kids.

Although legacy children have a roughly 3X higher chance of getting admitted than nonlegacy students, there is an understanding that alumni should provide regular donations to stay in good standings. Therefore, Rachel and Colin together donate $5,000 a year.

Finally, the Chens also contribute a maximum gift limit of $60,000 combined to their children’s 529 College Savings Plan. They are fortunate to have paid off their student loans years ago.

Food And Entertainment – $4,583/month

New York City is the best city in America for food and entertainment. Although many in San Francisco might contest this claim, the entertainment part of the equation is truly second to none.

The classic mutton chop at Keens Steakhouse costs $60 before tip and tax. Add on a glass of Cabernet Sauvignon, some creamed spinach, wedge salad, and a 1/2 dozen fresh oysters, and we’re easily talking $150 per person. A meal at one of my favorite restaurants, Le Bernardin, will easily cost $600 for a couple with wine pairing. Have a look yourself.

Le Bernardin, one of my favorite NYC restaurants for $300/person

After a nice meal, the Chens like to hit up a Broadway show. Tickets range from $60 up to $1,500 on average for the latest hot show. But given they aren’t earning multi-millions, they often settle for $250 tickets at most. In other words, a date night out easily costs $1,000+. Good thing they only go to shows about once a quarter because they’re often too busy or too tired to do anything more than have a meal at their favorite local sushi restaurant for $150 total.

When the Chens are not eating out, they’re eating home delivery from GrubHub, or having a simple home cooked meal prepared by Colin. Living in the culinary capital of America is both a blessing and a curse. Both Rachel and Colin are constantly watching their diets and working out so they don’t die prematurely.

Housing – $9,749/month

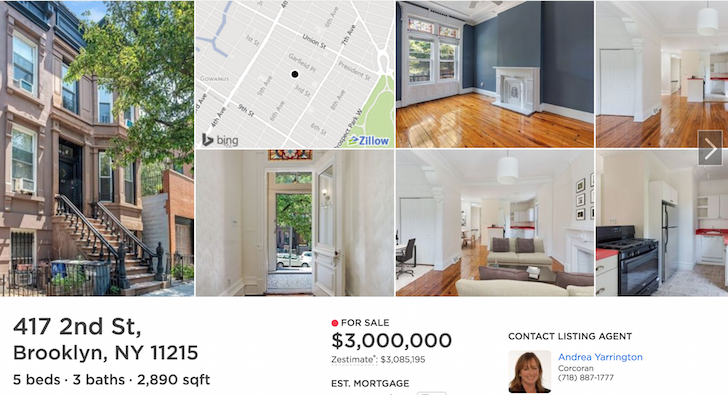

They own a 5 bedroom, 3 bathroom, 2,700 sqft brownstone in Park Slope, Brooklyn they bought in 2012 for $2,000,000. It was a fortuitous time as their brownstone has appreciated by roughly 40% six years later.

When their first child was born in 2008, they had owned a $1.3 million, two bedroom, one bathroom condo on the Lower East Side then bought in 2004. They realized very quickly that they needed more space for two kids.

Below is an example of a current listing for $3,000,000 that is similar to theirs. 2,700 sqft is perfect for their family of four. They plan to live in the house until their youngest goes off to university in 11 years.

With a loan-to-value ratio of just 53%, they feel comfortable paying down a $1,500,000 mortgage on her $1,000,000 income. They locked in a 30-year fixed interest rate at 4% in 2013 and can comfortably afford the $7,161 monthly mortgage payment, $2,600 of which goes to paying down principal.

Unfortunately, they’ve also got to pay property tax of $17,556 and home maintenance expenses of about $10,000 a year. Things tend to break or leak with old brownstones. They didn’t truly realize how much more it would cost to maintain a larger home with outdoor space compared to their condo in Manhattan. With the SALT deduction capped at $10,000, they will be losing out on thousands of dollars of tax deductions.

Vehicles And Transportation – $2,842/month

Colin is a car enthusiast, and Rachel appreciates the utility and safety of an SUV for her kids. As a result, they own the newest Range Rover Velar and Porsche 911S. The P380 Dynamic Velar is leased for $850/month. The Porsche 911S costs $1,400/month.

The Chens drive their Velar to the Hamptons many weekends during the summer where they rent a vacation house with friends. Colin drives his Porsche to the country club to play golf a couple times a week while the kids are in school. It’s his way of staying in shape and socializing given most of his peers still work full-time jobs.

Range Rover Velar family car for the kids – $78,000

Vacations – $40,000/Year

The Chens take three vacations outside of New York City a year plus a combined week’s worth of local vacation scattered through the year.

Given Rachel works ~65 hours a week, vacations are extremely valuable to her so she can recharge and spend quality time with family.

Rachel has long felt a tremendous amount of guilt for being away from her kids for so long, but she also realizes she’s in an enviable position to maximize her career earnings while the stock market is still hot. Eventually, the market will turn and it will become much harder for her to outperform.

The Chens’ favorite vacation spots are mostly in Europe: Dubrovnik, Almalfi Coast, St. Tropez, Provence, and Mallorca are some of their top destinations. It’s easy to fly to Europe from the East Coast, but every other year, they’ll take a trip back to see extended family in Taiwan. They also love visiting Japan, Thailand, and Vietnam when they can arrange two consecutive weeks off.

Each international trip for a family of four costs rooughly $13,500 for the week. The cost can be broken down as follows: $4,000 – $6,000 for economy class flights, $4,000 – $5,000 for 7 nights at a five-star hotel, and $2,000 – $4,000 for food, excursions, and souvenirs.

The remaining $5,000 out of their yearly $40,000 vacation budget is allocated towards being a NYC tourist.

A villa they rented in Santorini, Greece for $5,000/week

Clothes For Four – $24,000/year

Rachel loves clothes and shoes, and Colin doesn’t mind dressing up nicely to match his lovely wife, although he prefers to wear athletic gear all day. As a fund manager who expects to be taken seriously in a male-dominated industry, Rachel dresses her position.

Her pantsuits from Gucci, Dolce, and Chanel easily cost between $2,000 – $3,500 each. On average, she buys one work suit once a year to keep her threads fresh, although sometimes she buys a couple during holiday sales.

With every power suit must come matching Manolo Blahniks or Jimmy Choos at the cost of between $800 – $1,000 a pair on average. Below is a regular black satin pump by Manolo for $995 before tax at Nieman Marcus.

After the pumps, Rachel must of course own a work-appropriate tote bag that can cost anywhere from $1,000 – $3,000. She prefers the understated Prada bags with their hard waterproof exterior. Below are some of her clothing examples.

High powered jobs come with high priced clothes

Given Colin is a stay at home dad, he doesn’t need to spend anything on work clothes. However, he does own and appreciate an array of finely cut blazers to go along with his designer jeans and button down shirts for when they go out. Each custom blazer costs between $1,000 – $1,500 on average. Designer jeans run between $180 – $300, and shirts from the likes of Thomas Pink can range from $80 – $250. He only has one watch, a stainless steel Royal Oak Audemars Piguet he bought for $16,000 years ago.

Charity – $25,000 / Year

The Chens feel extremely fortunate to be in their position as second generation Americans whose parents worked lower income jobs to put them through school. When you are given the opportunity to make it beyond your wildest dreams in the greatest country on Earth, the Chens feel it’s their duty to regularly give roughly 2.5% of their gross income to charity.

Rachel and Colin are particularly passionate about helping foster kids get through a difficult system in order to be given a fair chance at life. They know their sons are extremely fortunate to attend private school, and deep down they feel it is unfair that their kids can have so much, while other kids, through no fault of their own can have so little. Given they aren’t going to reduce their son’s opportunities, they’ve decided to use most of the 2.5% to help less fortunate youth.

Net Worth Summary

Rachel has a target of working for 15 more years until her youngest son graduates college. Once both kids are through college, this will free up roughly $200,000 a year in after-tax children related expenses, which is equivalent to roughly $340,000 in gross income based on their 41% effective total tax rate.

After 15 years, the Chens should be able to accumulate at minimum:

- $277,500 in 401(k) plus $150,000 in profit sharing

- $816,495 in after-tax cashh

- $500,000 in principal pay down (leaving $1,000,000 left in mortgage)

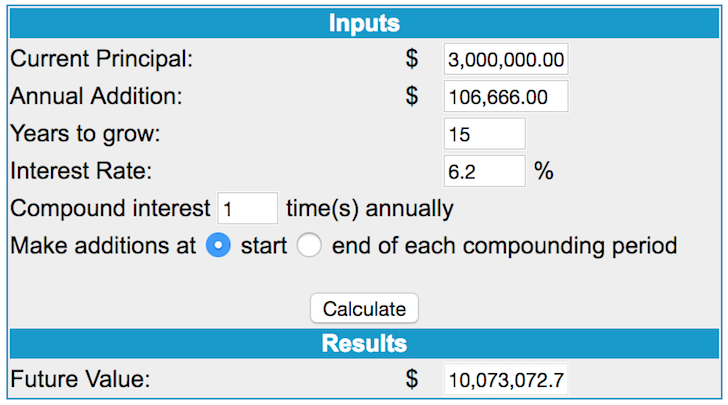

For a base case net worth increase of roughly $1,600,000 without any appreciation in their investments or house. Assuming $106,666 in base case net worth growth over 15 years, no compensation increase during this time period, and a current $3,000,000 net worth, including the equity in their primary residence, the Chens will conservatively have a $10,000,000 net worth by the time their youngest graduates from college using a 6.2% annual growth rate. She’ll be 60 years old and he’ll be 58.

Once their brownstone is paid off, they’ll save an additional $86,000 a year in after-tax cash flow, equivalent to $145,000 gross based on a 41% effective tax rate.

Therefore, the Chens can afford to maintain their lifestyles earning just $500,000 a year once they no longer have mortgage debt or child expenses. With a $10 million net worth, all they would need to do is figure out some way to generate a 5% return to live a great retirement and never touch principal for the rest of their lives.

Not Sure If It’s All Worth It

On paper, everything looks great for the Chens. Yet, Rachel tells me she doesn’t know if it’s worth working 65 hours a week for the next 15 years. Even the finest lobster at Le Bernardin or the most picturesque luxury villa off the Almalfi Coast gets old after a while.

Rachel sees a therapist every other week to help her manage the constant pressure she feels to provide for her family, outperform her peers, and outperform the markets. The market takes no prisoners. She’s only as good as her last month’s performance. This type of pressure has begun to pulverize what little peace and quiet she has left inside. She’s also recently begun to develop heart palpitations, which has her worried.

Colin also sees a therapist once a month to help him get through his feelings of unworthiness for being a stay at home father. Although he’s truly a great dad, he often feels gutted to have given up his management consulting job. None of his friends, who all work, understand what he’s going through. He feels isolated and often depressed. Sometimes he gets jealous of Rachel’s success, which leads to bitter fights.

What Rachel misses most is spending time with her boys, who are growing up too fast for her liking. Like middle age, where she now has a greater sense of her mortality, she knows that she might only have 5-7 years left to spend time with her sons before they would prefer spending all their free time with their friends. Before she knows it, they’ll be off to college where she might be lucky to see them twice a year.

Rachel envies Colin’s time at home. Most of her girlfriends are stay at home moms who take turns hosting playdates when their kids are off. When they’re in school, they often go to brunch at Blue Water Grill with bottomless mimosas over mounds of freshwater oysters. Colin envies Rachel’s freedom and the thrill of working in the real world with power.

Unfortunately, the only way to live a freer life is to drastically reduce expenses, have Colin go back to work, change their lifestyle completely, or accumulate at least 20X their annual expenses in net worth. At their current $500,000 annual burn rate, Rachel will truly need to work another 15 years to finally experience the joys of financial freedom. But she’s not sure if she can afford to wait that long.

If I was Rachel, I’d either ask for a three-month sabbatical or dial back work to 40 hours a week for less compensation. Making $500,000 a year with less stress, fewer hours, and a lower effective tax rate sounds so much more reasonable. They’ll have to cut down on entertainment, clothes, and travel, but they’ll gain back so much more quality time as a family.

Related:

Here’s When You’ll Finally Feel Rich

Be Rich, Not Famous: The Joys Of Being A Nobody

The Average Net Worth For The Above Average Married Couple

Readers, do you think earning $1 million a year is worth the stress, long work hours, and time away from family? How long would you be willing to work for $1 million a year before you decide to retire early? What would you do if you were the Chens? I’ll record a podcast about this episode in a day or two after I read some feedback on this post.

The post When Earning $1 Million A Year Isn’t Enough To Retire Early appeared first on Financial Samurai.

No comments:

Post a Comment