So here we are just a month later, in a full-blown economic panic, and at the start of the most sudden recession ever.

The pandemic has spread much further and faster than most uninformed people (including me) would have ever guessed, and the whole world is on some form of lockdown. Nothing quite like this has ever happened before in the modern world.

What should we do?

On the financial side, I’ve seen media stories about “The End of FIRE movement”, and even a close friend said to me, “Well, I’ve got to go back to work now because with all my investments down 35%, I’m not financially independent any more.”

And I’ve seen plenty of similar statements out there on the Internet:

Even worse, some people are trying to time the stock market, selling off their investments at a discount in the hopes of “protecting” them, hoping to subsequently outsmart everyone else and re-buy them at an even lower price just before some future rebound.

On the human side, we have seen a death toll of thousands of people per day in the US alone with best-case forecasts of 200,000 by the time things calm down, which implies several million worldwide.

And so far, we have not been performing like a best-case country so these numbers will probably be higher.

This all sounds terrible, doesn’t it?

It makes sense that many people are fearful and pessimistic. So why is it that I remain as optimistic as ever, with the full expectation that you and I will come through this humbled but also wiser and better than ever?

It’s because I already know how this all ends.

The world will keep rallying and doing its best to slow down contagion. Caring people will keep helping each other. People will stay home and heal, hospitals will expand, nurses and doctors will do their best to save as many lives as possible, and the 80% of us in jobs that allow us to keep working, will keep doing our jobs.

Meanwhile, innovators are still innovating all over the world. People are staying up late working in labs, vaccines are being tested, genes are being sequenced and the current virus will end up beaten and then written up as a very significant chapter in the history books.

But apart from all of this, there is still way more going on out there, which just isn’t making it to the headlines. Engineers and scientists are still inventing things that will drastically improve the future. Solar panels are still streaming out by the trainload and being installed worldwide. Better and better batteries which will eventually displace all fossil fuel use are evolving. The most efficient factories in history are being built. Gene therapies are advancing which will eventually make a mockery of all of our current health conditions. Internet connectivity and education is becoming more widely available and cheaper which is allowing the next generation of brilliant kids to to grow up and learn faster and do more than you or I could have even dreamed. And all this will happen regardless of the course of the current pandemic.

If all that is true, then why is the world so Scary right now?

I get it – never before has something from the daily news come home to affect our daily lives so much. Grocery stores are cleaned out, people are wearing masks, and you probably have friends who are currently unemployed, or sick, or both.

But in this situation, it really helps to understand the big picture of what is actually going on. The world is not ending. The air outside your windows is not a swirling cloud of certain death.

All that has changed is that we are in a self-imposed economic slowdown that has been created purely to save the lives of our most vulnerable people.

Which is one of the most compassionate things our society has ever done. To me, this is a remarkable and wonderful moment and I would not have guessed that such a capitalist country would ever have the balls to do it.

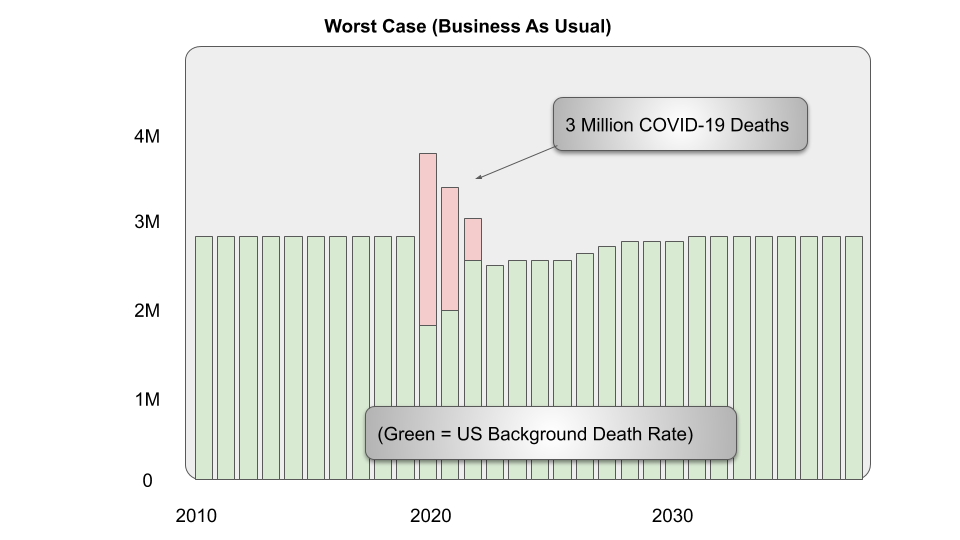

To put it into a visual, we have decided to prevent the following worst-case scenario:

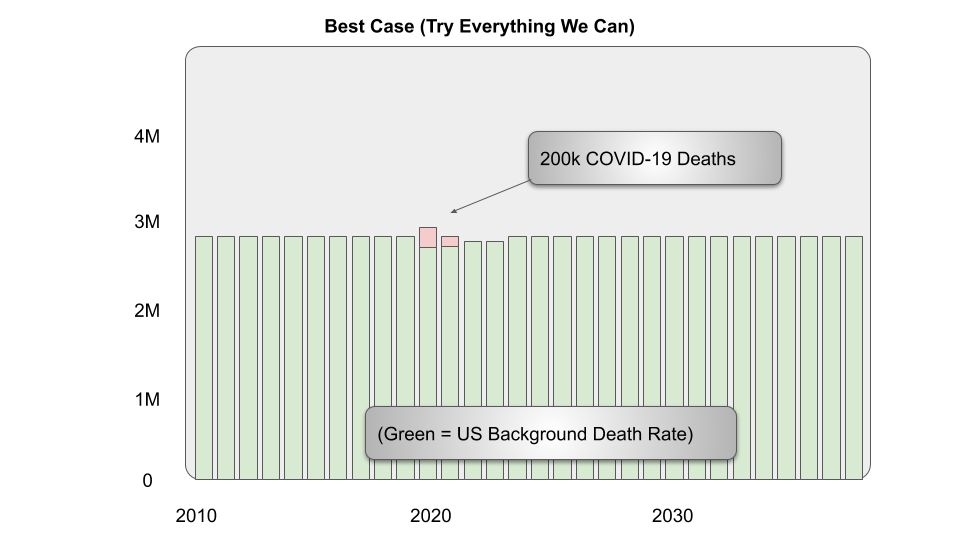

And turn it into this:

200,000 is still an enormous number, but the existing death rate at least puts it into perspective.

In the worst case, our public officials would all downplay the risk of COVID-19, and we’d keep working and traveling and spreading it freely. We’d maximize our economic activity and let the disease run its course.

From the disease models I have seen so far, about 70% of us would eventually contract it. Half of those would have no symptoms or very mild ones, a smaller (but still huge) number would get sick or very sick, 10% might end up in a very overloaded hospital system, and in total about 1-2% of our population would die from complications – partly depending on how quickly we could put up temporary treatment centers to cycle through 30 million people in only a few years.

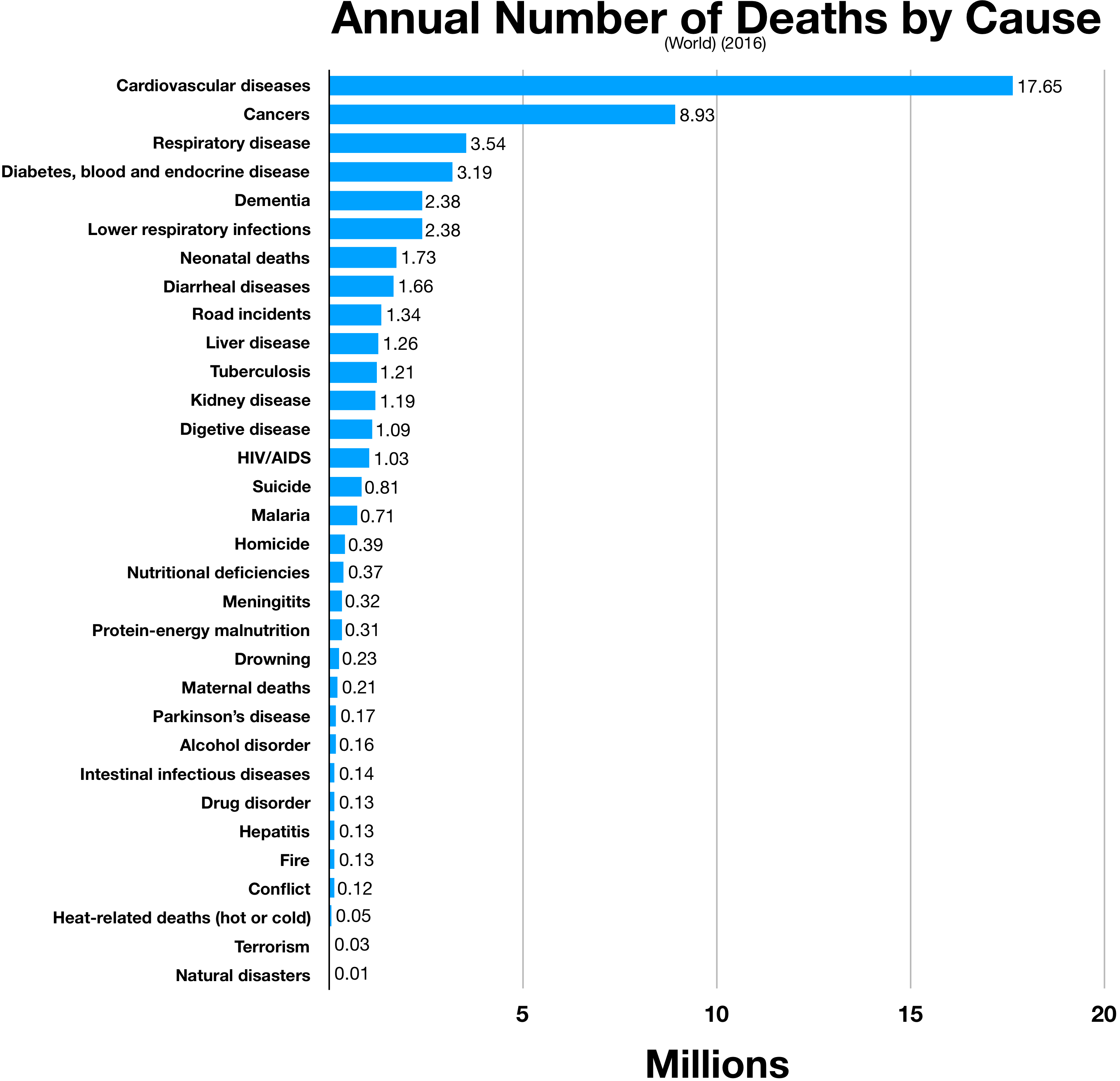

It would feel cruel and chaotic, but in reality we would still not be even approaching the conditions that people in the developing world deal with every day. Our world has always been cruel and chaotic in so many ways which effect a much larger number of people – we just happen to be used to them. And one thing that humans are exceptionally good at, is getting used to things.

In the more compassionate case which we are currently following, we drastically reduce the amount of contact we have with each other for a few months, which cuts the number of deaths in the US down from 3-6 million, down to perhaps 200,000. In exchange, our economy shrinks by several trillion dollars (it was about 21 trillion in 2019) for a year or more.

Assuming we are preventing 3 million early deaths, this means our society is foregoing about one million dollars of economic activity for each person’s life that we extend and frankly, it makes me happy to know we are capable of that.

So that’s the big picture: we are cautiously and temporarily buckling down and making some sacrifices, in order to help other people.

To me, that is not a cause for panic or fear – it’s a chance to try even harder and be thankful for such a once-in-a-lifetime opportunity.

Meanwhile, some good stuff is happening as a byproduct:

- We are driving around and polluting far less. The air is drastically cleaner everywhere.

- People are out walking with their kids far more. The streets of my town are nearly free from cars, and are being enjoyed by (appropriately spaced) bikes and people for the first time.

- Our expectations are being reset. Someday soon, it will feel like an absolute joy and privilege to walk into a store and see things fully stocked and prosperous again. And imagine the feeling of taking a vacation or attending a big event or a restaurant or a party!

- People in rich countries may realize that we can afford to be helpful and compassionate after all – while actually increasing our long term wealth and happiness rather than compromising it.

- And the world is getting a valuable “practice run” at handling a pandemic, with a relatively mild disease rather than something even more serious.

So How Does This Affect my Retirement?

Once you really get the big picture above, you can see that we are going to come through this better in every way.

Just as with any recession, weaker companies will go bankrupt, stronger ones will streamline their operations and get smarter, and the chaos and broken pieces will create become the raw materials from which an enormous batch of brand-new companies will form.

Better ways to track and treat disease, more scalable and less bureaucratic hospitals, more options for remote medicine and more support for remote work and virtual offices and virtual learning in general. More home delivery services and fewer big box stores and wasted parking lots, more support for biking and walking, and a million other things that a billion other people will think of.

The end result will be a better, more resilient and richer world than ever. Yes, that will also eventually mean more money in your retirement account, but more importantly it means better and happier living conditions for every living thing on Earth.

While this all sounds like optimistic magic, it’s actually just a byproduct of human nature. We are a lazy and change-averse creature and we become complacent when our fearful and primitive brains think things are “good enough” for survival and reproduction.

So, oddly enough, we often need a good slap upside the head to get off of our collective asses and actually make some improvements. Observe the wisdom of our elders:

- When the going gets tough, the tough get going.

- Necessity is the Mother of Invention.

- What doesn’t kill you, makes you stronger.

As old and repeated as these slogans might be, they stick around because they keep proving to be remarkably true. They are the real-world manifestation of a badassity that is built right into our Human DNA, which is why they are some of my favorite phrases in life.

Are things a bit hard right now?

GOOD.

See you in the inevitable and incredible boom-time that will result.

—-

Other Interesting Things That Might Help You Feel Better:

The Simple Path to Wealth, by my longtime author/blogger friend JL Collins, explains long-term investing in the most simple and calm way imaginable.

Towards Rational Exuberance is a more technical and detailed (but still very fun to read) history of the stock market and how the Federal Reserve bank serves to stabilize our system. Although I read this book over fifteen years ago, it has underpinned my understanding and confidence in long-term investing ever since. I would love it if author Mark Smith would add a few chapters to cover the two most recent market crashes as well!

A Guided Meditation for when the Stock Market is Dropping, is Jim’s witty YouTube reminder of the same thing, which he somehow created long before any of this panic started – how could he possibly have known in advance??

Good News, there’s Another Recession Coming is my own magical forecast of the present moment, made over two years ago.

Why We are Not Really All Doomed, my 2014 take on why the world was (and still is) well positioned for many decades of future prosperity.

How To Retire Forever on a Fixed Chunk of Money gets into the reason why stock market drops like the present one don’t really hurt an early retiree (it’s because the vast majority of your shares will be sold several decades from now, when the present panic is barely a blip on the graph.

And finally, just for fun here’s an example of something that is not written to make you feel better. In recent weeks, I spent several hours writing out some interview answers for an article in the New York Times.

I was truly excited to share the details of why the Principles of Mustachianism are more useful than ever in times like these, and it’s quite the opposite of “The End of FIRE” that the silly and financially naive media have been peddling in recent stories.

I was disappointed in the end result. Most of my answers were cut out, and instead the article is focused on “hardships” that other early retirees are currently working through. And the clickbaity title sets the expectations wrong to begin with:

They All Retired Before They Hit 40. And Then This Happened.

(that link will take you to my Twitter post about it, where an interesting discussion has formed in the comments – what do you think?)

No comments:

Post a Comment